ETS 模型¶

ETS 模型是一组基于状态空间模型的时间序列模型,该模型由一个水平分量、一个趋势分量(T)、一个季节性分量(S)和一个误差项(E)组成。

本笔记本展示了如何与statsmodels一起使用。对于更深入的处理,我们参考[1],第8章(免费在线资源),该章节是statsmodels中的实现以及本笔记本中使用的示例的基础。

statsmodels 实现了所有组合: - 加性和乘性误差模型 - 加性和乘性趋势,可能衰减 - 加性和乘性季节性

然而,并非所有这些方法都是稳定的。有关模型稳定性的更多信息,请参阅[1]及其参考文献。

[1] Hyndman, Rob J., 和 Athanasopoulos, George. 预测:原理与实践,第三版,OTexts, 2021. https://otexts.com/fpp3/expsmooth.html

[1]:

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

%matplotlib inline

from statsmodels.tsa.exponential_smoothing.ets import ETSModel

[2]:

plt.rcParams["figure.figsize"] = (12, 8)

简单指数平滑¶

最简单的ETS模型也被称为简单指数平滑。在ETS术语中,它对应于(A, N, N)模型,即具有加性误差、无趋势和无季节性的模型。Holt方法的状态空间公式如下:

\begin{align} y_{t} &= y_{t-1} + e_t\\ l_{t} &= l_{t-1} + \alpha e_t\\ \end{align}

这种状态空间公式可以转换为不同的公式,即预测和平滑方程(所有ETS模型都可以这样做):

\begin{align} \hat{y}_{t|t-1} &= l_{t-1}\\ l_{t} &= \alpha y_{t-1} + (1 - \alpha) l_{t-1} \end{align}

在这里,\(\hat{y}_{t|t-1}\) 是根据前一步信息对 \(y_t\) 的预测/期望。在简单指数平滑模型中,预测对应于前一个水平。第二个方程(平滑方程)计算下一个水平为前一个水平和前一个观测值的加权平均。

[3]:

oildata = [

111.0091,

130.8284,

141.2871,

154.2278,

162.7409,

192.1665,

240.7997,

304.2174,

384.0046,

429.6622,

359.3169,

437.2519,

468.4008,

424.4353,

487.9794,

509.8284,

506.3473,

340.1842,

240.2589,

219.0328,

172.0747,

252.5901,

221.0711,

276.5188,

271.1480,

342.6186,

428.3558,

442.3946,

432.7851,

437.2497,

437.2092,

445.3641,

453.1950,

454.4096,

422.3789,

456.0371,

440.3866,

425.1944,

486.2052,

500.4291,

521.2759,

508.9476,

488.8889,

509.8706,

456.7229,

473.8166,

525.9509,

549.8338,

542.3405,

]

oil = pd.Series(oildata, index=pd.date_range("1965", "2013", freq="YS"))

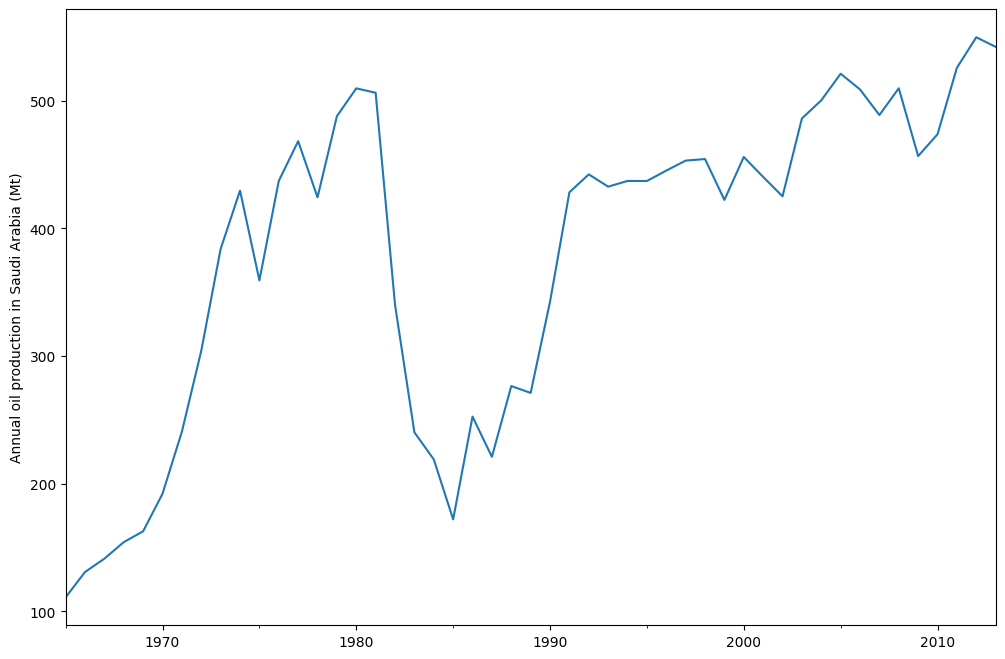

oil.plot()

plt.ylabel("Annual oil production in Saudi Arabia (Mt)")

[3]:

Text(0, 0.5, 'Annual oil production in Saudi Arabia (Mt)')

上图显示了沙特阿拉伯的年石油产量,单位为百万吨。数据来自R包fpp2(先前版本的配套包[1])。下面你可以看到如何使用statsmodels的ETS实现来拟合一个简单的指数平滑模型到这些数据。此外,还展示了使用R中的forecast进行拟合的比较。

[4]:

model = ETSModel(oil)

fit = model.fit(maxiter=10000)

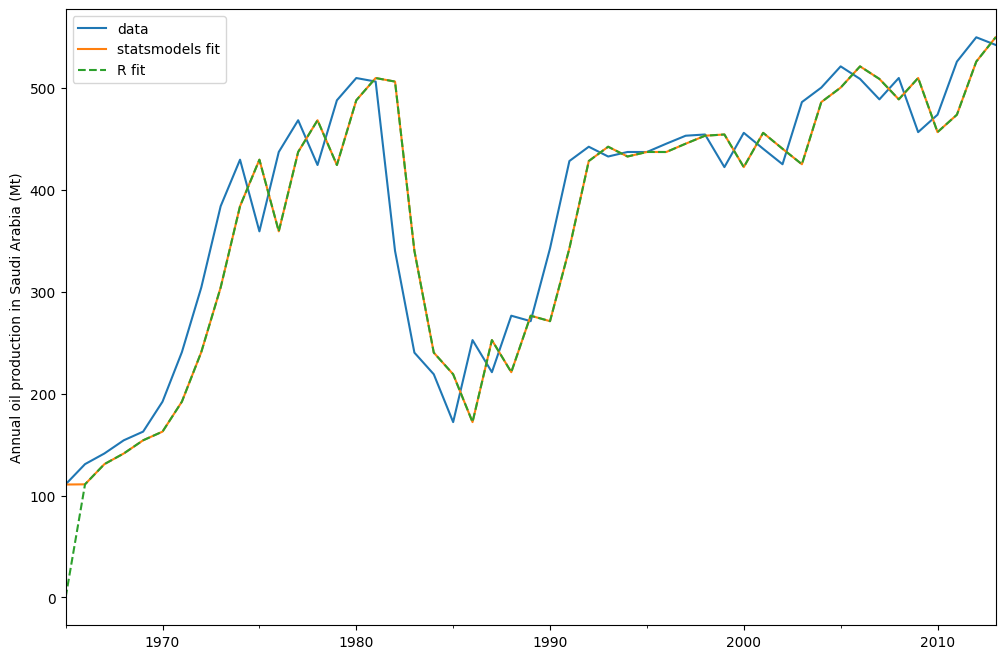

oil.plot(label="data")

fit.fittedvalues.plot(label="statsmodels fit")

plt.ylabel("Annual oil production in Saudi Arabia (Mt)")

# obtained from R

params_R = [0.99989969, 0.11888177503085334, 0.80000197, 36.46466837, 34.72584983]

yhat = model.smooth(params_R).fittedvalues

yhat.plot(label="R fit", linestyle="--")

plt.legend()

RUNNING THE L-BFGS-B CODE

* * *

Machine precision = 2.220D-16

N = 2 M = 10

At X0 0 variables are exactly at the bounds

At iterate 0 f= 6.27365D+00 |proj g|= 8.99900D-01

At iterate 1 f= 5.31675D+00 |proj g|= 6.49880D-04

At iterate 2 f= 5.30939D+00 |proj g|= 5.55378D-04

At iterate 3 f= 5.29115D+00 |proj g|= 5.80869D-05

At iterate 4 f= 5.29096D+00 |proj g|= 2.04281D-06

* * *

Tit = total number of iterations

Tnf = total number of function evaluations

Tnint = total number of segments explored during Cauchy searches

Skip = number of BFGS updates skipped

Nact = number of active bounds at final generalized Cauchy point

Projg = norm of the final projected gradient

F = final function value

* * *

N Tit Tnf Tnint Skip Nact Projg F

2 4 13 5 0 1 2.043D-06 5.291D+00

F = 5.2909564634118551

CONVERG

[4]:

<matplotlib.legend.Legend at 0x1044e3d10>

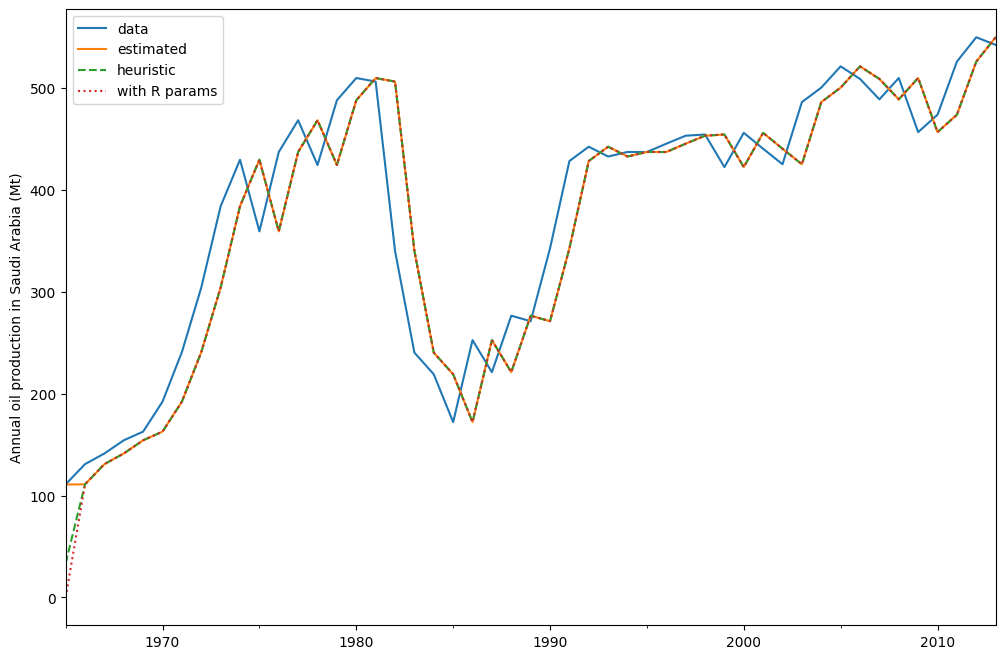

默认情况下,初始状态被视为拟合参数,并通过最大化对数似然来估计。也可以仅使用启发式方法来确定初始值:

[5]:

model_heuristic = ETSModel(oil, initialization_method="heuristic")

fit_heuristic = model_heuristic.fit()

oil.plot(label="data")

fit.fittedvalues.plot(label="estimated")

fit_heuristic.fittedvalues.plot(label="heuristic", linestyle="--")

plt.ylabel("Annual oil production in Saudi Arabia (Mt)")

# obtained from R

params = [0.99989969, 0.11888177503085334, 0.80000197, 36.46466837, 34.72584983]

yhat = model.smooth(params).fittedvalues

yhat.plot(label="with R params", linestyle=":")

plt.legend()

[5]:

<matplotlib.legend.Legend at 0x1166a3c90>

拟合参数和其他一些指标通过 fit.summary() 显示。在这里我们可以看到,使用拟合初始状态的模型的对数似然值略低于使用启发式初始状态的模型。

[6]:

print(fit.summary())

ETS Results

==============================================================================

Dep. Variable: y No. Observations: 49

Model: ETS(ANN) Log Likelihood -259.257

Date: Wed, 16 Oct 2024 AIC 524.514

Time: 18:27:49 BIC 530.189

Sample: 01-01-1965 HQIC 526.667

- 01-01-2013 Scale 2307.767

Covariance Type: approx

===================================================================================

coef std err z P>|z| [0.025 0.975]

-----------------------------------------------------------------------------------

smoothing_level 0.9999 0.132 7.551 0.000 0.740 1.259

initial_level 110.7864 48.110 2.303 0.021 16.492 205.081

===================================================================================

Ljung-Box (Q): 1.87 Jarque-Bera (JB): 20.78

Prob(Q): 0.39 Prob(JB): 0.00

Heteroskedasticity (H): 0.49 Skew: -1.04

Prob(H) (two-sided): 0.16 Kurtosis: 5.42

===================================================================================

Warnings:

[1] Covariance matrix calculated using numerical (complex-step) differentiation.

[7]:

print(fit_heuristic.summary())

ETS Results

==============================================================================

Dep. Variable: y No. Observations: 49

Model: ETS(ANN) Log Likelihood -260.521

Date: Wed, 16 Oct 2024 AIC 525.042

Time: 18:27:49 BIC 528.826

Sample: 01-01-1965 HQIC 526.477

- 01-01-2013 Scale 2429.964

Covariance Type: approx

===================================================================================

coef std err z P>|z| [0.025 0.975]

-----------------------------------------------------------------------------------

smoothing_level 0.9999 0.132 7.559 0.000 0.741 1.259

==============================================

initialization method: heuristic

----------------------------------------------

initial_level 33.6309

===================================================================================

Ljung-Box (Q): 1.85 Jarque-Bera (JB): 18.42

Prob(Q): 0.40 Prob(JB): 0.00

Heteroskedasticity (H): 0.44 Skew: -1.02

Prob(H) (two-sided): 0.11 Kurtosis: 5.21

===================================================================================

Warnings:

[1] Covariance matrix calculated using numerical (complex-step) differentiation.

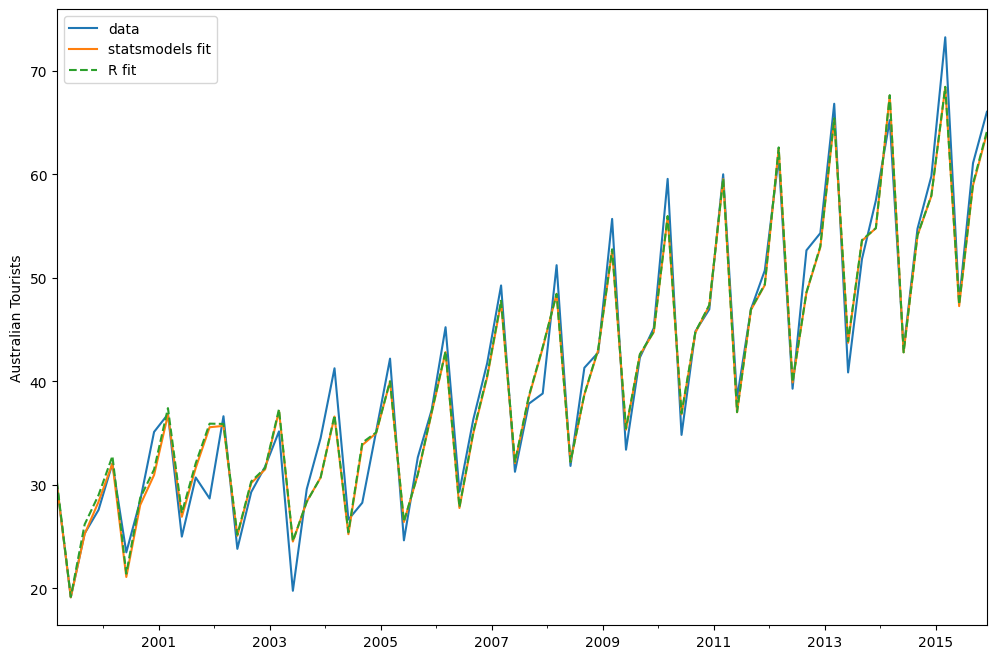

Holt-Winters’ 季节性方法¶

指数平滑法可以进行修改以包含趋势和季节性成分。在加性Holt-Winters方法中,季节性成分被添加到其余部分。该模型对应于ETS(A, A, A)模型,并具有以下状态空间公式:

\begin{align} y_t &= l_{t-1} + b_{t-1} + s_{t-m} + e_t\\ l_{t} &= l_{t-1} + b_{t-1} + \alpha e_t\\ b_{t} &= b_{t-1} + \beta e_t\\ s_{t} &= s_{t-m} + \gamma e_t \end{align}

[8]:

austourists_data = [

30.05251300,

19.14849600,

25.31769200,

27.59143700,

32.07645600,

23.48796100,

28.47594000,

35.12375300,

36.83848500,

25.00701700,

30.72223000,

28.69375900,

36.64098600,

23.82460900,

29.31168300,

31.77030900,

35.17787700,

19.77524400,

29.60175000,

34.53884200,

41.27359900,

26.65586200,

28.27985900,

35.19115300,

42.20566386,

24.64917133,

32.66733514,

37.25735401,

45.24246027,

29.35048127,

36.34420728,

41.78208136,

49.27659843,

31.27540139,

37.85062549,

38.83704413,

51.23690034,

31.83855162,

41.32342126,

42.79900337,

55.70835836,

33.40714492,

42.31663797,

45.15712257,

59.57607996,

34.83733016,

44.84168072,

46.97124960,

60.01903094,

38.37117851,

46.97586413,

50.73379646,

61.64687319,

39.29956937,

52.67120908,

54.33231689,

66.83435838,

40.87118847,

51.82853579,

57.49190993,

65.25146985,

43.06120822,

54.76075713,

59.83447494,

73.25702747,

47.69662373,

61.09776802,

66.05576122,

]

index = pd.date_range("1999-03-01", "2015-12-01", freq="3MS")

austourists = pd.Series(austourists_data, index=index)

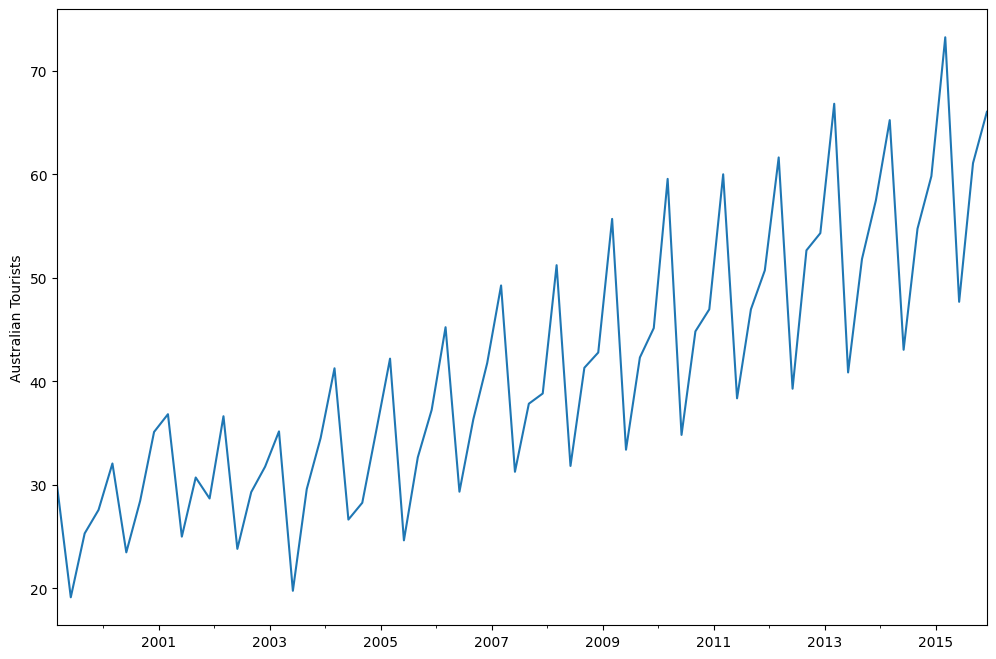

austourists.plot()

plt.ylabel("Australian Tourists")

[8]:

Text(0, 0.5, 'Australian Tourists')

[9]:

# fit in statsmodels

model = ETSModel(

austourists,

error="add",

trend="add",

seasonal="add",

damped_trend=True,

seasonal_periods=4,

)

fit = model.fit()

# fit with R params

params_R = [

0.35445427,

0.03200749,

0.39993387,

0.97999997,

24.01278357,

0.97770147,

1.76951063,

-0.50735902,

-6.61171798,

5.34956637,

]

fit_R = model.smooth(params_R)

austourists.plot(label="data")

plt.ylabel("Australian Tourists")

fit.fittedvalues.plot(label="statsmodels fit")

fit_R.fittedvalues.plot(label="R fit", linestyle="--")

plt.legend()

[9]:

<matplotlib.legend.Legend at 0x11672bdd0>

[10]:

print(fit.summary())

ETS Results

==============================================================================

Dep. Variable: y No. Observations: 68

Model: ETS(AAdA) Log Likelihood -152.627

Date: Wed, 16 Oct 2024 AIC 327.254

Time: 18:27:50 BIC 351.668

Sample: 03-01-1999 HQIC 336.928

- 12-01-2015 Scale 5.213

Covariance Type: approx

======================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------------

smoothing_level 0.3399 0.111 3.070 0.002 0.123 0.557

smoothing_trend 0.0259 0.008 3.162 0.002 0.010 0.042

smoothing_seasonal 0.4010 0.080 5.041 0.000 0.245 0.557

damping_trend 0.9800 nan nan nan nan nan

initial_level 29.4450 nan nan nan nan nan

initial_trend 0.6143 0.392 1.566 0.117 -0.155 1.383

initial_seasonal.0 -3.4295 nan nan nan nan nan

initial_seasonal.1 -5.9545 nan nan nan nan nan

initial_seasonal.2 -11.4913 nan nan nan nan nan

initial_seasonal.3 0 nan nan nan nan nan

===================================================================================

Ljung-Box (Q): 5.76 Jarque-Bera (JB): 7.70

Prob(Q): 0.67 Prob(JB): 0.02

Heteroskedasticity (H): 0.46 Skew: -0.63

Prob(H) (two-sided): 0.07 Kurtosis: 4.05

===================================================================================

Warnings:

[1] Covariance matrix calculated using numerical (complex-step) differentiation.

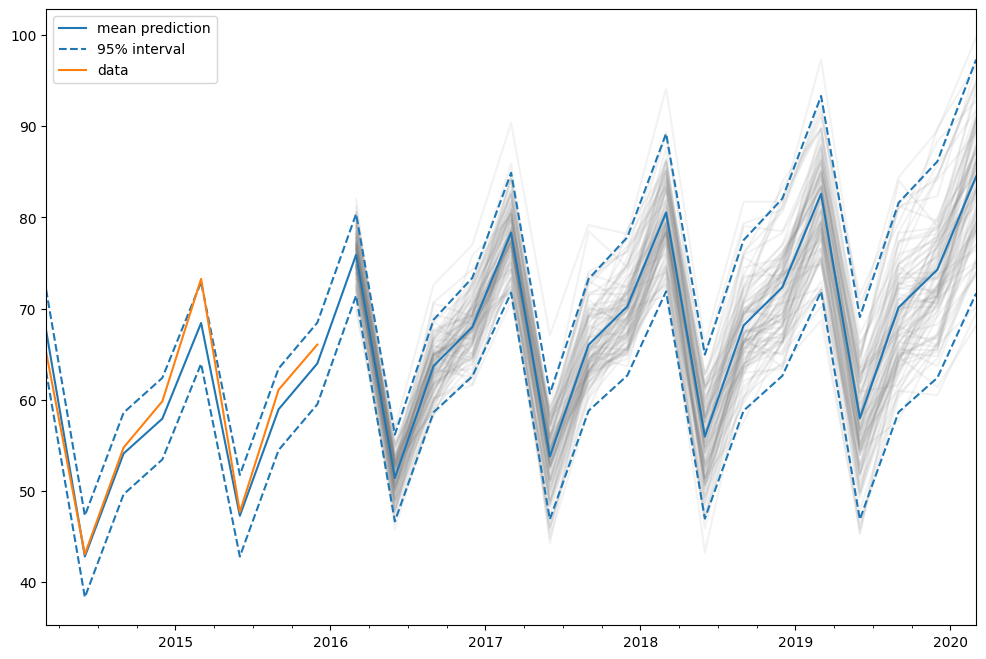

预测¶

ETS模型也可以用于预测。有几种不同的方法可用:- forecast:进行样本外预测 - predict:样本内和样本外预测 - simulate:运行状态空间模型的模拟 - get_prediction:样本内和样本外预测,以及预测区间

我们可以在之前拟合的模型上使用它们来预测从2014年到2020年的数据。

[11]:

pred = fit.get_prediction(start="2014", end="2020")

[12]:

df = pred.summary_frame(alpha=0.05)

df

[12]:

| mean | pi_lower | pi_upper | |

|---|---|---|---|

| 2014-03-01 | 67.611216 | 63.136242 | 72.086191 |

| 2014-06-01 | 42.815135 | 38.340161 | 47.290109 |

| 2014-09-01 | 54.106583 | 49.631609 | 58.581558 |

| 2014-12-01 | 57.928184 | 53.453210 | 62.403158 |

| 2015-03-01 | 68.422418 | 63.947444 | 72.897392 |

| 2015-06-01 | 47.278586 | 42.803612 | 51.753561 |

| 2015-09-01 | 58.955314 | 54.480340 | 63.430289 |

| 2015-12-01 | 63.982579 | 59.507605 | 68.457553 |

| 2016-03-01 | 75.905700 | 71.430726 | 80.380674 |

| 2016-06-01 | 51.418965 | 46.654738 | 56.183192 |

| 2016-09-01 | 63.704186 | 58.630024 | 68.778348 |

| 2016-12-01 | 67.979000 | 62.576247 | 73.381754 |

| 2017-03-01 | 78.316987 | 71.736510 | 84.897463 |

| 2017-06-01 | 53.782026 | 46.884445 | 60.679607 |

| 2017-09-01 | 66.019986 | 58.789068 | 73.250904 |

| 2017-12-01 | 70.248484 | 62.669361 | 77.827607 |

| 2018-03-01 | 80.541081 | 71.893487 | 89.188675 |

| 2018-06-01 | 55.961638 | 46.969207 | 64.954069 |

| 2018-09-01 | 68.156006 | 58.805956 | 77.506055 |

| 2018-12-01 | 72.341783 | 62.622337 | 82.061229 |

| 2019-03-01 | 82.592514 | 71.865267 | 93.319761 |

| 2019-06-01 | 57.972043 | 46.876656 | 69.067429 |

| 2019-09-01 | 70.126202 | 58.652547 | 81.599858 |

| 2019-12-01 | 74.272576 | 62.411290 | 86.133862 |

| 2020-03-01 | 84.484691 | 71.656555 | 97.312827 |

在这种情况下,预测区间是使用一个解析公式计算的。并非所有模型都提供这种方法。对于这些其他模型,预测区间是通过执行多次模拟(默认情况下为1000次)并使用模拟结果的百分位数来计算的。这是由get_prediction方法在内部完成的。

我们也可以手动运行模拟,例如绘制它们。由于数据范围直到2015年底,我们必须从2016年第一季度模拟到2020年第一季度,这意味着17个步骤。

[13]:

simulated = fit.simulate(anchor="end", nsimulations=17, repetitions=100)

[14]:

for i in range(simulated.shape[1]):

simulated.iloc[:, i].plot(label="_", color="gray", alpha=0.1)

df["mean"].plot(label="mean prediction")

df["pi_lower"].plot(linestyle="--", color="tab:blue", label="95% interval")

df["pi_upper"].plot(linestyle="--", color="tab:blue", label="_")

pred.endog.plot(label="data")

plt.legend()

[14]:

<matplotlib.legend.Legend at 0x116a73d10>

在这种情况下,我们选择“end”作为模拟锚点,这意味着第一个模拟值将是第一个样本外的值。也可以选择样本内的其他锚点。