指数平滑¶

让我们考虑Hyndman和Athanasopoulos[1]关于指数平滑的优秀著作中的第7章。我们将逐一完成本章中的所有示例。

[1] Hyndman, Rob J., 和 George Athanasopoulos. 预测:原理与实践. OTexts, 2014.

加载数据¶

首先我们加载一些数据。为了方便起见,我们在笔记本中包含了R数据。

[1]:

import os

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from statsmodels.tsa.api import ExponentialSmoothing, SimpleExpSmoothing, Holt

%matplotlib inline

data = [

446.6565,

454.4733,

455.663,

423.6322,

456.2713,

440.5881,

425.3325,

485.1494,

506.0482,

526.792,

514.2689,

494.211,

]

index = pd.date_range(start="1996", end="2008", freq="Y")

oildata = pd.Series(data, index)

data = [

17.5534,

21.86,

23.8866,

26.9293,

26.8885,

28.8314,

30.0751,

30.9535,

30.1857,

31.5797,

32.5776,

33.4774,

39.0216,

41.3864,

41.5966,

]

index = pd.date_range(start="1990", end="2005", freq="Y")

air = pd.Series(data, index)

data = [

263.9177,

268.3072,

260.6626,

266.6394,

277.5158,

283.834,

290.309,

292.4742,

300.8307,

309.2867,

318.3311,

329.3724,

338.884,

339.2441,

328.6006,

314.2554,

314.4597,

321.4138,

329.7893,

346.3852,

352.2979,

348.3705,

417.5629,

417.1236,

417.7495,

412.2339,

411.9468,

394.6971,

401.4993,

408.2705,

414.2428,

]

index = pd.date_range(start="1970", end="2001", freq="Y")

livestock2 = pd.Series(data, index)

data = [407.9979, 403.4608, 413.8249, 428.105, 445.3387, 452.9942, 455.7402]

index = pd.date_range(start="2001", end="2008", freq="Y")

livestock3 = pd.Series(data, index)

data = [

41.7275,

24.0418,

32.3281,

37.3287,

46.2132,

29.3463,

36.4829,

42.9777,

48.9015,

31.1802,

37.7179,

40.4202,

51.2069,

31.8872,

40.9783,

43.7725,

55.5586,

33.8509,

42.0764,

45.6423,

59.7668,

35.1919,

44.3197,

47.9137,

]

index = pd.date_range(start="2005", end="2010-Q4", freq="QS-OCT")

aust = pd.Series(data, index)

/var/folders/xc/cwj7_pwj6lb0lkpyjtcbm7y80000gn/T/ipykernel_80852/536270367.py:23: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

index = pd.date_range(start="1996", end="2008", freq="Y")

/var/folders/xc/cwj7_pwj6lb0lkpyjtcbm7y80000gn/T/ipykernel_80852/536270367.py:43: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

index = pd.date_range(start="1990", end="2005", freq="Y")

/var/folders/xc/cwj7_pwj6lb0lkpyjtcbm7y80000gn/T/ipykernel_80852/536270367.py:79: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

index = pd.date_range(start="1970", end="2001", freq="Y")

/var/folders/xc/cwj7_pwj6lb0lkpyjtcbm7y80000gn/T/ipykernel_80852/536270367.py:83: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

index = pd.date_range(start="2001", end="2008", freq="Y")

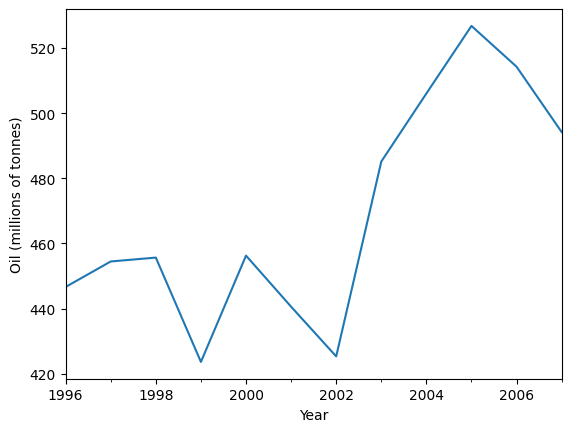

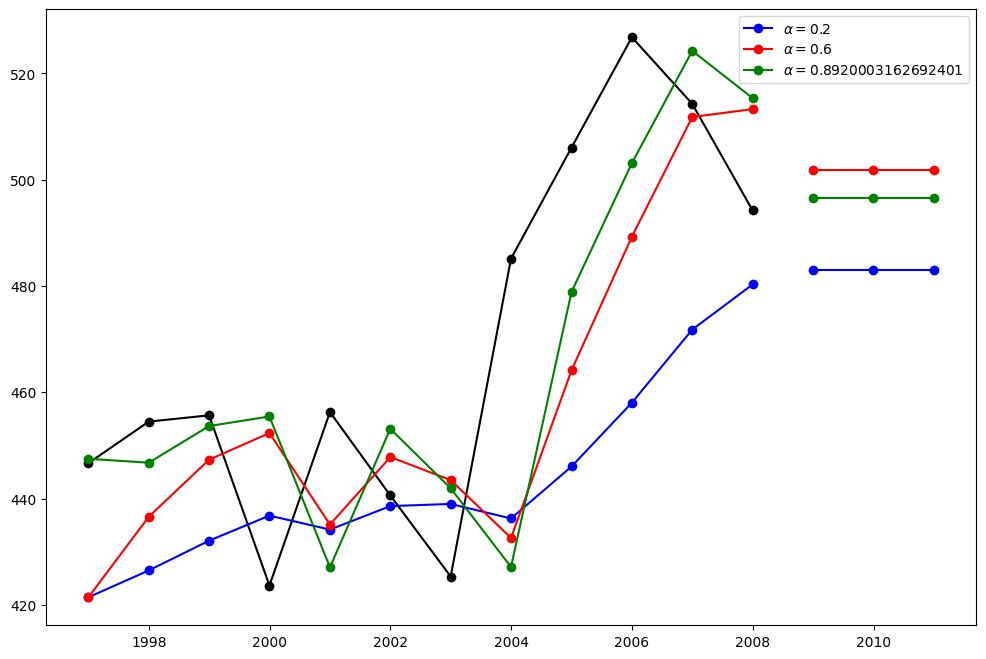

简单指数平滑¶

让我们使用简单指数平滑法来预测下面的石油数据。

[2]:

ax = oildata.plot()

ax.set_xlabel("Year")

ax.set_ylabel("Oil (millions of tonnes)")

print("Figure 7.1: Oil production in Saudi Arabia from 1996 to 2007.")

Figure 7.1: Oil production in Saudi Arabia from 1996 to 2007.

这里我们运行了三种简单指数平滑的变体:1. 在 fit1 中,我们不使用自动优化,而是选择显式地为模型提供 \(\alpha=0.2\) 参数 2. 在 fit2 中,如上所述,我们选择 \(\alpha=0.6\) 3. 在 fit3 中,我们允许 statsmodels 自动为我们找到优化的 \(\alpha\) 值。这是推荐的方法。

[3]:

fit1 = SimpleExpSmoothing(oildata, initialization_method="heuristic").fit(

smoothing_level=0.2, optimized=False

)

fcast1 = fit1.forecast(3).rename(r"$\alpha=0.2$")

fit2 = SimpleExpSmoothing(oildata, initialization_method="heuristic").fit(

smoothing_level=0.6, optimized=False

)

fcast2 = fit2.forecast(3).rename(r"$\alpha=0.6$")

fit3 = SimpleExpSmoothing(oildata, initialization_method="estimated").fit()

fcast3 = fit3.forecast(3).rename(r"$\alpha=%s$" % fit3.model.params["smoothing_level"])

plt.figure(figsize=(12, 8))

plt.plot(oildata, marker="o", color="black")

plt.plot(fit1.fittedvalues, marker="o", color="blue")

(line1,) = plt.plot(fcast1, marker="o", color="blue")

plt.plot(fit2.fittedvalues, marker="o", color="red")

(line2,) = plt.plot(fcast2, marker="o", color="red")

plt.plot(fit3.fittedvalues, marker="o", color="green")

(line3,) = plt.plot(fcast3, marker="o", color="green")

plt.legend([line1, line2, line3], [fcast1.name, fcast2.name, fcast3.name])

[3]:

<matplotlib.legend.Legend at 0x10dc27ed0>

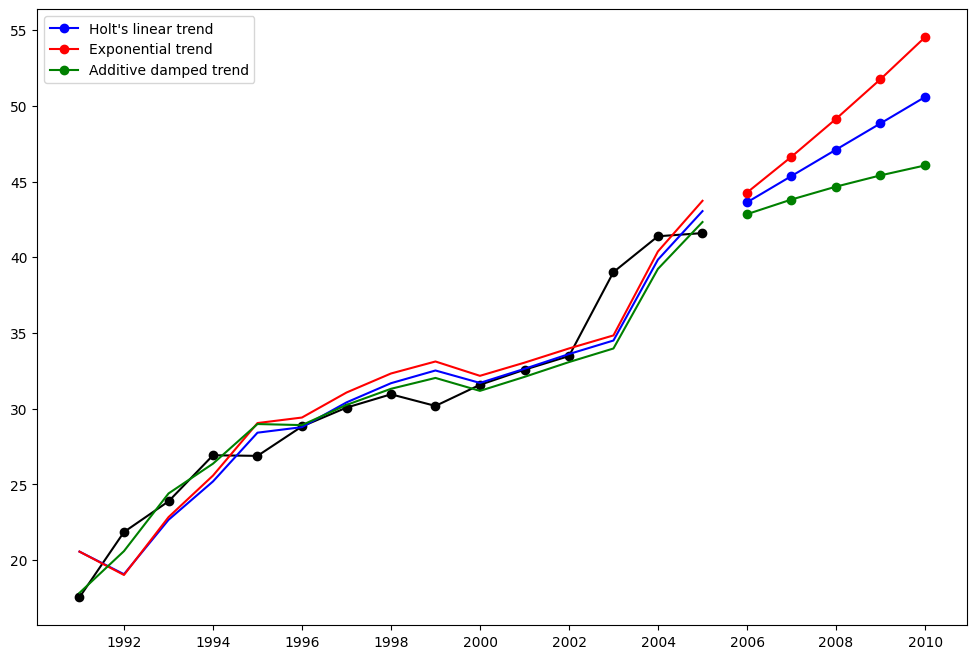

霍尔特方法¶

让我们来看另一个例子。这次我们使用空气污染数据和Holt方法。我们将再次拟合三个例子。1. 在fit1中,我们再次选择不使用优化器,并为\(\alpha=0.8\)和\(\beta=0.2\)提供显式值。2. 在fit2中,我们做了与fit1相同的事情,但选择使用指数模型而不是Holt的加法模型。3. 在fit3中,我们使用了Holt加法模型的阻尼版本,但允许阻尼参数\(\phi\)进行优化,同时固定\(\alpha=0.8\)和\(\beta=0.2\)的值。

[4]:

fit1 = Holt(air, initialization_method="estimated").fit(

smoothing_level=0.8, smoothing_trend=0.2, optimized=False

)

fcast1 = fit1.forecast(5).rename("Holt's linear trend")

fit2 = Holt(air, exponential=True, initialization_method="estimated").fit(

smoothing_level=0.8, smoothing_trend=0.2, optimized=False

)

fcast2 = fit2.forecast(5).rename("Exponential trend")

fit3 = Holt(air, damped_trend=True, initialization_method="estimated").fit(

smoothing_level=0.8, smoothing_trend=0.2

)

fcast3 = fit3.forecast(5).rename("Additive damped trend")

plt.figure(figsize=(12, 8))

plt.plot(air, marker="o", color="black")

plt.plot(fit1.fittedvalues, color="blue")

(line1,) = plt.plot(fcast1, marker="o", color="blue")

plt.plot(fit2.fittedvalues, color="red")

(line2,) = plt.plot(fcast2, marker="o", color="red")

plt.plot(fit3.fittedvalues, color="green")

(line3,) = plt.plot(fcast3, marker="o", color="green")

plt.legend([line1, line2, line3], [fcast1.name, fcast2.name, fcast3.name])

[4]:

<matplotlib.legend.Legend at 0x10dcd81d0>

季节性调整数据¶

让我们来看一些季节性调整后的牲畜数据。我们拟合了五个Holt模型。下表允许我们在使用指数与加法以及阻尼与非阻尼时比较结果。

注意:fit4 不允许通过提供固定值 \(\phi=0.98\) 来优化参数 \(\phi\)

[5]:

fit1 = SimpleExpSmoothing(livestock2, initialization_method="estimated").fit()

fit2 = Holt(livestock2, initialization_method="estimated").fit()

fit3 = Holt(livestock2, exponential=True, initialization_method="estimated").fit()

fit4 = Holt(livestock2, damped_trend=True, initialization_method="estimated").fit(

damping_trend=0.98

)

fit5 = Holt(

livestock2, exponential=True, damped_trend=True, initialization_method="estimated"

).fit()

params = [

"smoothing_level",

"smoothing_trend",

"damping_trend",

"initial_level",

"initial_trend",

]

results = pd.DataFrame(

index=[r"$\alpha$", r"$\beta$", r"$\phi$", r"$l_0$", "$b_0$", "SSE"],

columns=["SES", "Holt's", "Exponential", "Additive", "Multiplicative"],

)

results["SES"] = [fit1.params[p] for p in params] + [fit1.sse]

results["Holt's"] = [fit2.params[p] for p in params] + [fit2.sse]

results["Exponential"] = [fit3.params[p] for p in params] + [fit3.sse]

results["Additive"] = [fit4.params[p] for p in params] + [fit4.sse]

results["Multiplicative"] = [fit5.params[p] for p in params] + [fit5.sse]

results

[5]:

| SES | Holt's | Exponential | Additive | Multiplicative | |

|---|---|---|---|---|---|

| $\alpha$ | 1.000000 | 0.974306 | 9.776418e-01 | 0.978850 | 0.974894 |

| $\beta$ | NaN | 0.000000 | 3.628848e-07 | 0.000000 | 0.000026 |

| $\phi$ | NaN | NaN | NaN | 0.980000 | 0.981636 |

| $l_0$ | 263.917735 | 258.882592 | 2.603437e+02 | 257.357619 | 258.950949 |

| $b_0$ | NaN | 5.010781 | 1.013780e+00 | 6.644640 | 1.038157 |

| SSE | 6761.350235 | 6004.138200 | 6.104197e+03 | 6036.555004 | 6082.163796 |

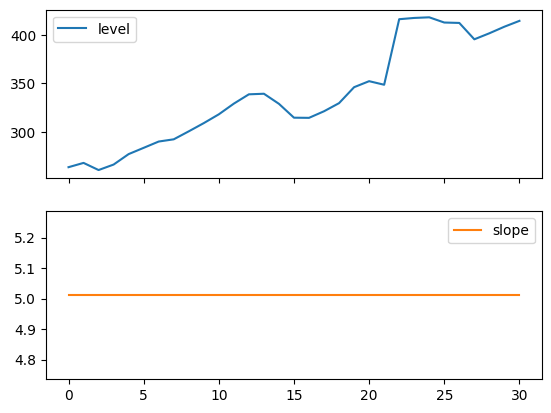

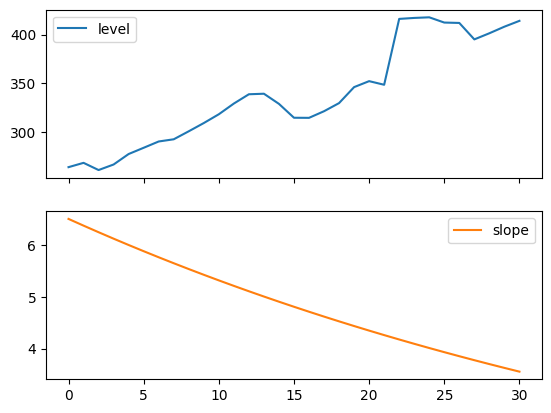

季节性调整数据的图表¶

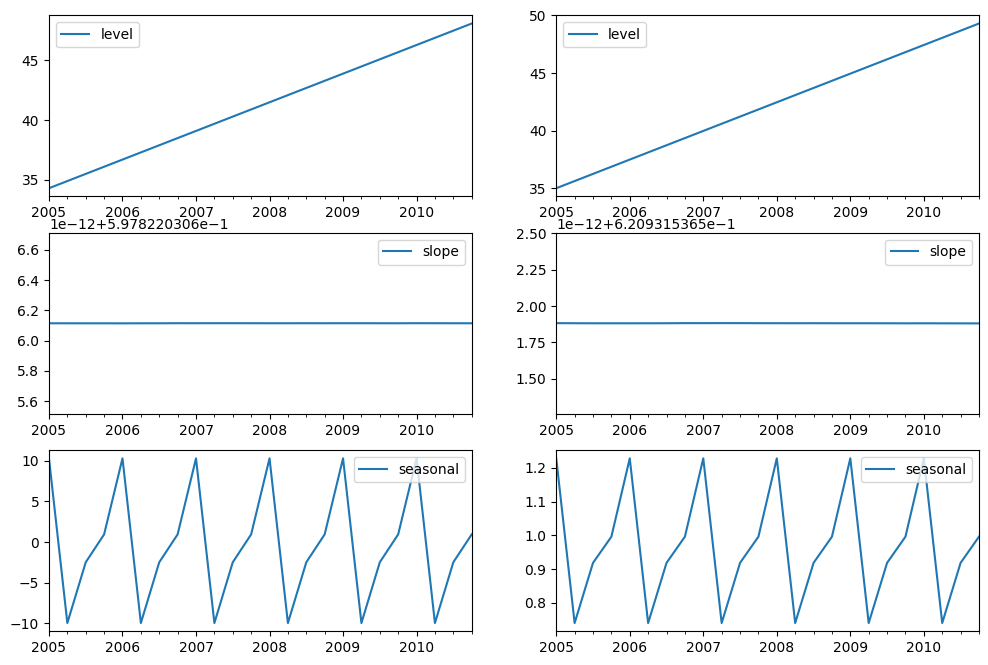

以下图表允许我们评估上述表格拟合的水平和斜率/趋势分量。

[6]:

for fit in [fit2, fit4]:

pd.DataFrame(np.c_[fit.level, fit.trend]).rename(

columns={0: "level", 1: "slope"}

).plot(subplots=True)

plt.show()

print(

"Figure 7.4: Level and slope components for Holt’s linear trend method and the additive damped trend method."

)

Figure 7.4: Level and slope components for Holt’s linear trend method and the additive damped trend method.

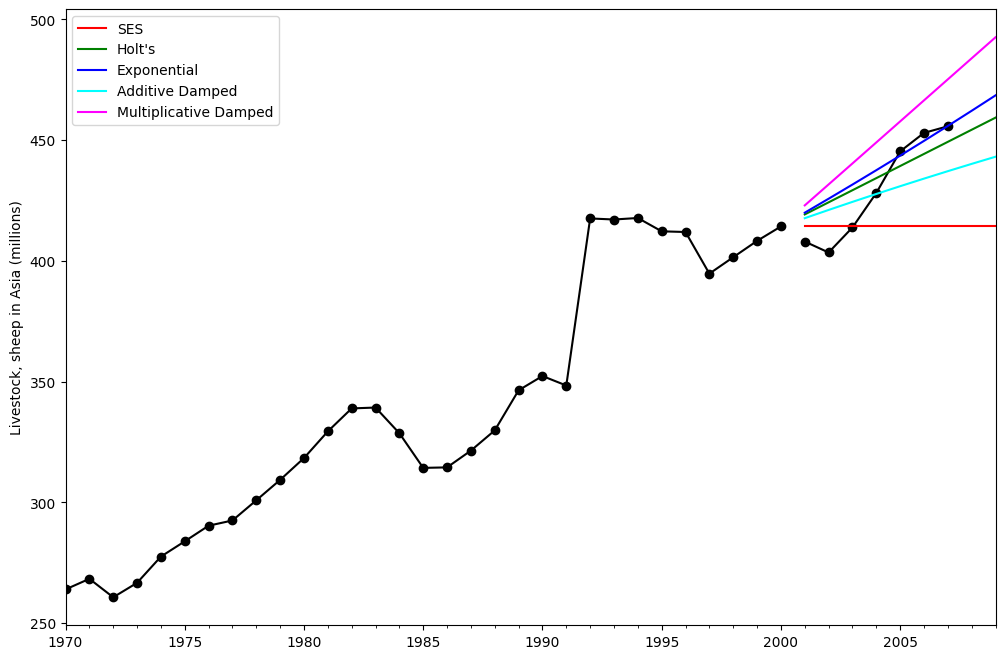

比较¶

这里我们绘制了简单指数平滑法和霍尔特方法在各种加法、指数和阻尼组合下的比较。所有模型的参数将由statsmodels优化。

[7]:

fit1 = SimpleExpSmoothing(livestock2, initialization_method="estimated").fit()

fcast1 = fit1.forecast(9).rename("SES")

fit2 = Holt(livestock2, initialization_method="estimated").fit()

fcast2 = fit2.forecast(9).rename("Holt's")

fit3 = Holt(livestock2, exponential=True, initialization_method="estimated").fit()

fcast3 = fit3.forecast(9).rename("Exponential")

fit4 = Holt(livestock2, damped_trend=True, initialization_method="estimated").fit(

damping_trend=0.98

)

fcast4 = fit4.forecast(9).rename("Additive Damped")

fit5 = Holt(

livestock2, exponential=True, damped_trend=True, initialization_method="estimated"

).fit()

fcast5 = fit5.forecast(9).rename("Multiplicative Damped")

ax = livestock2.plot(color="black", marker="o", figsize=(12, 8))

livestock3.plot(ax=ax, color="black", marker="o", legend=False)

fcast1.plot(ax=ax, color="red", legend=True)

fcast2.plot(ax=ax, color="green", legend=True)

fcast3.plot(ax=ax, color="blue", legend=True)

fcast4.plot(ax=ax, color="cyan", legend=True)

fcast5.plot(ax=ax, color="magenta", legend=True)

ax.set_ylabel("Livestock, sheep in Asia (millions)")

plt.show()

print(

"Figure 7.5: Forecasting livestock, sheep in Asia: comparing forecasting performance of non-seasonal methods."

)

Figure 7.5: Forecasting livestock, sheep in Asia: comparing forecasting performance of non-seasonal methods.

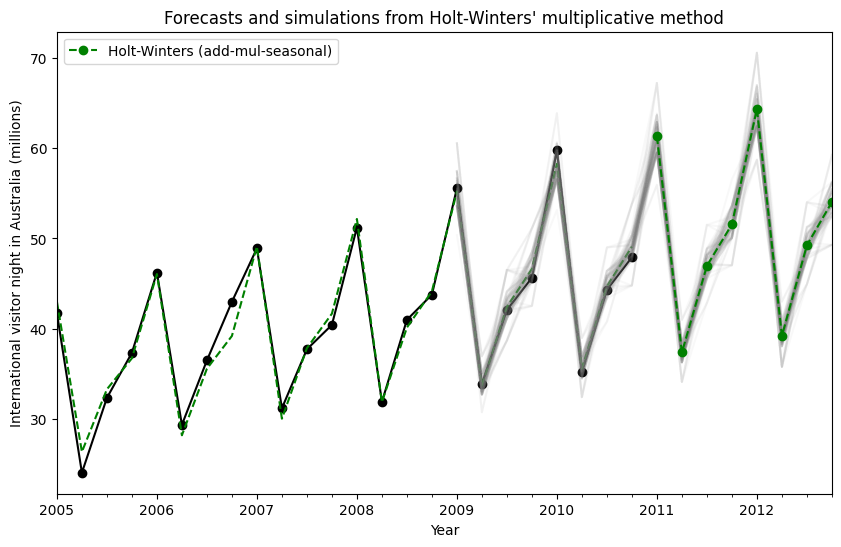

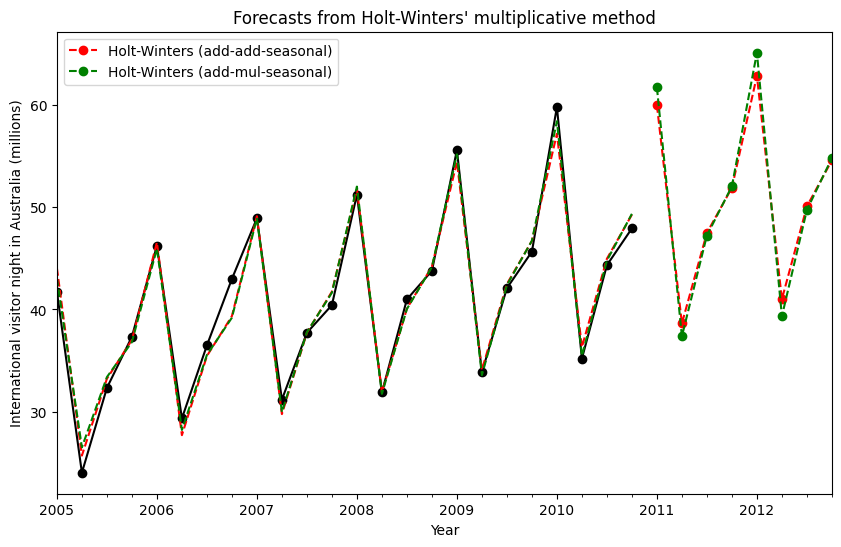

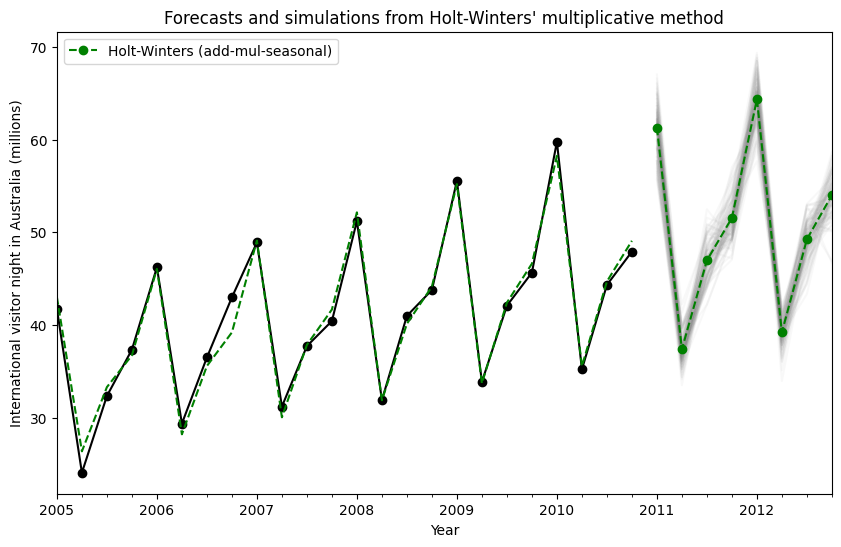

Holt’s Winters 季节性¶

最后,我们能够运行完整的Holt’s Winters季节性指数平滑,包括趋势分量和季节性分量。statsmodels允许所有组合,如下面的示例所示:1. fit1 加性趋势,周期为season_length=4的加性季节性,并使用Box-Cox变换。1. fit2 加性趋势,周期为season_length=4的乘性季节性,并使用Box-Cox变换。1. fit3 加性阻尼趋势,周期为season_length=4的加性季节性,并使用Box-Cox变换。1. fit4 加性阻尼趋势,周期为season_length=4的乘性季节性,并使用Box-Cox变换。

该图显示了fit1和fit2的结果和预测。该表允许我们比较结果和参数化。

[8]:

fit1 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="add",

use_boxcox=True,

initialization_method="estimated",

).fit()

fit2 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

use_boxcox=True,

initialization_method="estimated",

).fit()

fit3 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="add",

damped_trend=True,

use_boxcox=True,

initialization_method="estimated",

).fit()

fit4 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

damped_trend=True,

use_boxcox=True,

initialization_method="estimated",

).fit()

results = pd.DataFrame(

index=[r"$\alpha$", r"$\beta$", r"$\phi$", r"$\gamma$", r"$l_0$", "$b_0$", "SSE"]

)

params = [

"smoothing_level",

"smoothing_trend",

"damping_trend",

"smoothing_seasonal",

"initial_level",

"initial_trend",

]

results["Additive"] = [fit1.params[p] for p in params] + [fit1.sse]

results["Multiplicative"] = [fit2.params[p] for p in params] + [fit2.sse]

results["Additive Dam"] = [fit3.params[p] for p in params] + [fit3.sse]

results["Multiplica Dam"] = [fit4.params[p] for p in params] + [fit4.sse]

ax = aust.plot(

figsize=(10, 6),

marker="o",

color="black",

title="Forecasts from Holt-Winters' multiplicative method",

)

ax.set_ylabel("International visitor night in Australia (millions)")

ax.set_xlabel("Year")

fit1.fittedvalues.plot(ax=ax, style="--", color="red")

fit2.fittedvalues.plot(ax=ax, style="--", color="green")

fit1.forecast(8).rename("Holt-Winters (add-add-seasonal)").plot(

ax=ax, style="--", marker="o", color="red", legend=True

)

fit2.forecast(8).rename("Holt-Winters (add-mul-seasonal)").plot(

ax=ax, style="--", marker="o", color="green", legend=True

)

plt.show()

print(

"Figure 7.6: Forecasting international visitor nights in Australia using Holt-Winters method with both additive and multiplicative seasonality."

)

results

Figure 7.6: Forecasting international visitor nights in Australia using Holt-Winters method with both additive and multiplicative seasonality.

[8]:

| Additive | Multiplicative | Additive Dam | Multiplica Dam | |

|---|---|---|---|---|

| $\alpha$ | 1.490116e-08 | 1.490116e-08 | 1.490116e-08 | 1.490116e-08 |

| $\beta$ | 1.409869e-08 | 1.308971e-23 | 6.490801e-09 | 5.042240e-09 |

| $\phi$ | NaN | NaN | 9.430416e-01 | 9.536044e-01 |

| $\gamma$ | 3.312830e-15 | 0.000000e+00 | 1.008101e-16 | 0.000000e+00 |

| $l_0$ | 1.119348e+01 | 1.106381e+01 | 1.084022e+01 | 9.899308e+00 |

| $b_0$ | 1.205396e-01 | 1.198963e-01 | 2.456750e-01 | 1.975449e-01 |

| SSE | 4.402746e+01 | 3.611262e+01 | 3.527620e+01 | 3.062033e+01 |

内部机制¶

可以获取指数平滑模型的内部信息。

这里我们展示了一些表格,允许您并排查看原始值 \(y_t\)、水平 \(l_t\)、趋势 \(b_t\)、季节 \(s_t\) 和拟合值 \(\hat{y}_t\)。请注意,如果未进行Box-Cox变换,这些值仅在原始数据的空间中具有有意义的值。

[9]:

fit1 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="add",

initialization_method="estimated",

).fit()

fit2 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

initialization_method="estimated",

).fit()

[10]:

df = pd.DataFrame(

np.c_[aust, fit1.level, fit1.trend, fit1.season, fit1.fittedvalues],

columns=[r"$y_t$", r"$l_t$", r"$b_t$", r"$s_t$", r"$\hat{y}_t$"],

index=aust.index,

)

forecasts = fit1.forecast(8).rename(r"$\hat{y}_t$").to_frame()

df = pd.concat([df, forecasts], axis=0, sort=True)

[11]:

df = pd.DataFrame(

np.c_[aust, fit2.level, fit2.trend, fit2.season, fit2.fittedvalues],

columns=[r"$y_t$", r"$l_t$", r"$b_t$", r"$s_t$", r"$\hat{y}_t$"],

index=aust.index,

)

forecasts = fit2.forecast(8).rename(r"$\hat{y}_t$").to_frame()

df = pd.concat([df, forecasts], axis=0, sort=True)

最后,让我们来看看模型的水平、斜率/趋势和季节性成分。

[12]:

states1 = pd.DataFrame(

np.c_[fit1.level, fit1.trend, fit1.season],

columns=["level", "slope", "seasonal"],

index=aust.index,

)

states2 = pd.DataFrame(

np.c_[fit2.level, fit2.trend, fit2.season],

columns=["level", "slope", "seasonal"],

index=aust.index,

)

fig, [[ax1, ax4], [ax2, ax5], [ax3, ax6]] = plt.subplots(3, 2, figsize=(12, 8))

states1[["level"]].plot(ax=ax1)

states1[["slope"]].plot(ax=ax2)

states1[["seasonal"]].plot(ax=ax3)

states2[["level"]].plot(ax=ax4)

states2[["slope"]].plot(ax=ax5)

states2[["seasonal"]].plot(ax=ax6)

plt.show()

模拟与置信区间¶

通过使用状态空间公式,我们可以进行未来值的模拟。数学细节在Hyndman和Athanasopoulos [2] 以及 HoltWintersResults.simulate 的文档中有描述。

类似于[2]中的示例,我们使用具有加性趋势、乘性季节性和乘性误差的模型。我们模拟未来最多8步,并进行1000次模拟。如下图所示,模拟结果与预测值非常吻合。

[2] Hyndman, Rob J., 和 George Athanasopoulos. 预测:原理与实践,第二版。OTexts, 2018.

[13]:

fit = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

initialization_method="estimated",

).fit()

simulations = fit.simulate(8, repetitions=100, error="mul")

ax = aust.plot(

figsize=(10, 6),

marker="o",

color="black",

title="Forecasts and simulations from Holt-Winters' multiplicative method",

)

ax.set_ylabel("International visitor night in Australia (millions)")

ax.set_xlabel("Year")

fit.fittedvalues.plot(ax=ax, style="--", color="green")

simulations.plot(ax=ax, style="-", alpha=0.05, color="grey", legend=False)

fit.forecast(8).rename("Holt-Winters (add-mul-seasonal)").plot(

ax=ax, style="--", marker="o", color="green", legend=True

)

plt.show()

模拟也可以在不同的时间点开始,并且有多种选择来选择随机噪声。

[14]:

fit = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

initialization_method="estimated",

).fit()

simulations = fit.simulate(

16, anchor="2009-01-01", repetitions=100, error="mul", random_errors="bootstrap"

)

ax = aust.plot(

figsize=(10, 6),

marker="o",

color="black",

title="Forecasts and simulations from Holt-Winters' multiplicative method",

)

ax.set_ylabel("International visitor night in Australia (millions)")

ax.set_xlabel("Year")

fit.fittedvalues.plot(ax=ax, style="--", color="green")

simulations.plot(ax=ax, style="-", alpha=0.05, color="grey", legend=False)

fit.forecast(8).rename("Holt-Winters (add-mul-seasonal)").plot(

ax=ax, style="--", marker="o", color="green", legend=True

)

plt.show()