时间序列过滤器¶

[1]:

%matplotlib inline

[2]:

import pandas as pd

import matplotlib.pyplot as plt

import statsmodels.api as sm

[3]:

dta = sm.datasets.macrodata.load_pandas().data

[4]:

index = pd.Index(sm.tsa.datetools.dates_from_range("1959Q1", "2009Q3"))

print(index)

DatetimeIndex(['1959-03-31', '1959-06-30', '1959-09-30', '1959-12-31',

'1960-03-31', '1960-06-30', '1960-09-30', '1960-12-31',

'1961-03-31', '1961-06-30',

...

'2007-06-30', '2007-09-30', '2007-12-31', '2008-03-31',

'2008-06-30', '2008-09-30', '2008-12-31', '2009-03-31',

'2009-06-30', '2009-09-30'],

dtype='datetime64[ns]', length=203, freq=None)

[5]:

dta.index = index

del dta["year"]

del dta["quarter"]

[6]:

print(sm.datasets.macrodata.NOTE)

::

Number of Observations - 203

Number of Variables - 14

Variable name definitions::

year - 1959q1 - 2009q3

quarter - 1-4

realgdp - Real gross domestic product (Bil. of chained 2005 US$,

seasonally adjusted annual rate)

realcons - Real personal consumption expenditures (Bil. of chained

2005 US$, seasonally adjusted annual rate)

realinv - Real gross private domestic investment (Bil. of chained

2005 US$, seasonally adjusted annual rate)

realgovt - Real federal consumption expenditures & gross investment

(Bil. of chained 2005 US$, seasonally adjusted annual rate)

realdpi - Real private disposable income (Bil. of chained 2005

US$, seasonally adjusted annual rate)

cpi - End of the quarter consumer price index for all urban

consumers: all items (1982-84 = 100, seasonally adjusted).

m1 - End of the quarter M1 nominal money stock (Seasonally

adjusted)

tbilrate - Quarterly monthly average of the monthly 3-month

treasury bill: secondary market rate

unemp - Seasonally adjusted unemployment rate (%)

pop - End of the quarter total population: all ages incl. armed

forces over seas

infl - Inflation rate (ln(cpi_{t}/cpi_{t-1}) * 400)

realint - Real interest rate (tbilrate - infl)

[7]:

print(dta.head(10))

realgdp realcons realinv realgovt realdpi cpi m1 \

1959-03-31 2710.349 1707.4 286.898 470.045 1886.9 28.98 139.7

1959-06-30 2778.801 1733.7 310.859 481.301 1919.7 29.15 141.7

1959-09-30 2775.488 1751.8 289.226 491.260 1916.4 29.35 140.5

1959-12-31 2785.204 1753.7 299.356 484.052 1931.3 29.37 140.0

1960-03-31 2847.699 1770.5 331.722 462.199 1955.5 29.54 139.6

1960-06-30 2834.390 1792.9 298.152 460.400 1966.1 29.55 140.2

1960-09-30 2839.022 1785.8 296.375 474.676 1967.8 29.75 140.9

1960-12-31 2802.616 1788.2 259.764 476.434 1966.6 29.84 141.1

1961-03-31 2819.264 1787.7 266.405 475.854 1984.5 29.81 142.1

1961-06-30 2872.005 1814.3 286.246 480.328 2014.4 29.92 142.9

tbilrate unemp pop infl realint

1959-03-31 2.82 5.8 177.146 0.00 0.00

1959-06-30 3.08 5.1 177.830 2.34 0.74

1959-09-30 3.82 5.3 178.657 2.74 1.09

1959-12-31 4.33 5.6 179.386 0.27 4.06

1960-03-31 3.50 5.2 180.007 2.31 1.19

1960-06-30 2.68 5.2 180.671 0.14 2.55

1960-09-30 2.36 5.6 181.528 2.70 -0.34

1960-12-31 2.29 6.3 182.287 1.21 1.08

1961-03-31 2.37 6.8 182.992 -0.40 2.77

1961-06-30 2.29 7.0 183.691 1.47 0.81

[8]:

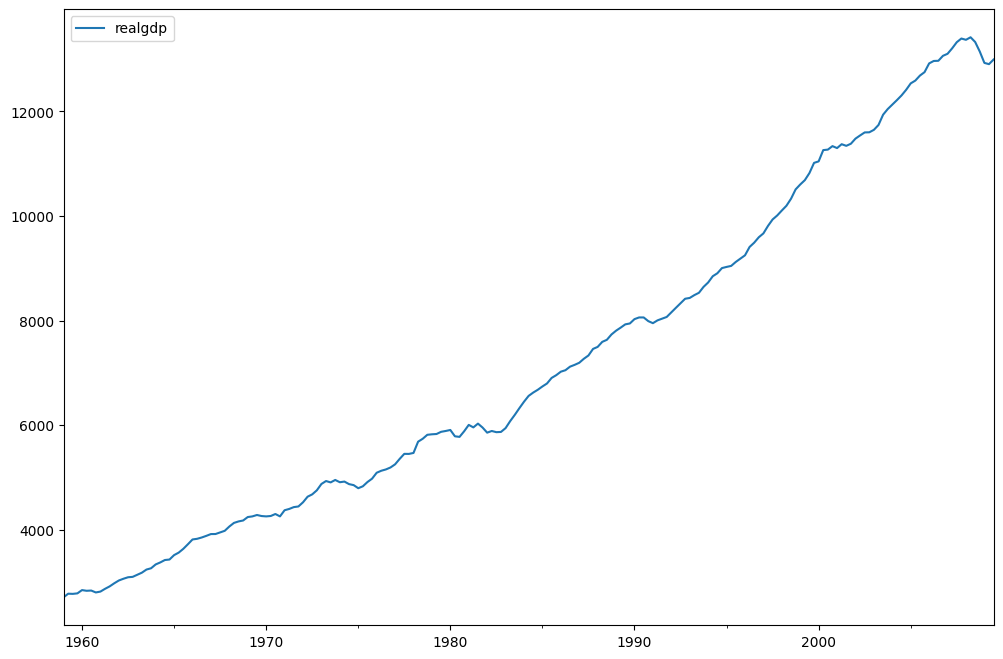

fig = plt.figure(figsize=(12, 8))

ax = fig.add_subplot(111)

dta.realgdp.plot(ax=ax)

legend = ax.legend(loc="upper left")

legend.prop.set_size(20)

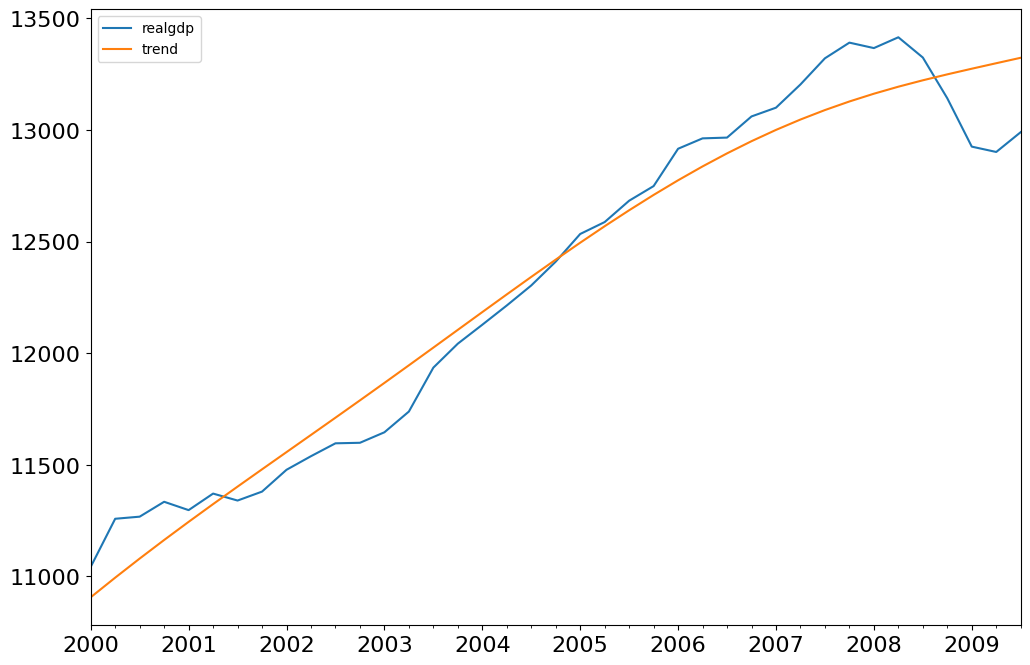

Hodrick-Prescott 滤波器¶

Hodrick-Prescott滤波器将时间序列\(y_t\)分解为趋势\(\tau_t\)和周期性成分\(\zeta_t\)

通过最小化以下二次损失函数来确定组件

[9]:

gdp_cycle, gdp_trend = sm.tsa.filters.hpfilter(dta.realgdp)

[10]:

gdp_decomp = dta[["realgdp"]].copy()

gdp_decomp["cycle"] = gdp_cycle

gdp_decomp["trend"] = gdp_trend

[11]:

fig = plt.figure(figsize=(12, 8))

ax = fig.add_subplot(111)

gdp_decomp[["realgdp", "trend"]]["2000-03-31":].plot(ax=ax, fontsize=16)

legend = ax.get_legend()

legend.prop.set_size(20)

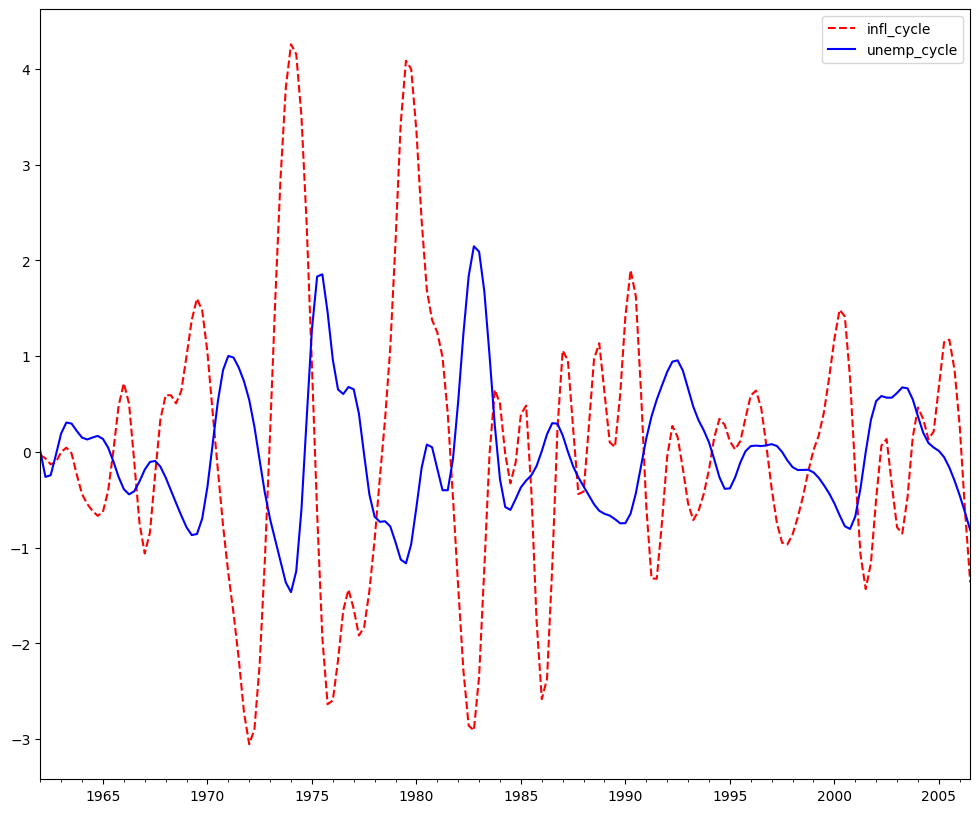

Baxter-King近似带通滤波器: 通货膨胀和失业¶

探讨通货膨胀和失业率呈反周期性的假设。¶

Baxter-King 滤波器旨在明确处理商业周期的周期性。通过将他们的带通滤波器应用于一个序列,他们生成一个不包含高于或低于商业周期波动的新序列。具体来说,BK 滤波器采用对称移动平均的形式

其中 \(a_{-k}=a_k\) 且 \(\sum_{k=-k}^{K}a_k=0\) 以消除序列中的任何趋势,并使其平稳,如果序列是 I(1) 或 I(2)。

为了完整性,过滤器权重确定如下

其中 \(\theta\) 是一个归一化常数,使得权重之和为零。

\(P_L\) 和 \(P_H\) 是低和高截止频率的周期性。根据Burns和Mitchell关于美国商业周期的研究,建议周期持续时间为1.5到8年,我们默认使用 \(P_L=6\) 和 \(P_H=32\)。

[12]:

bk_cycles = sm.tsa.filters.bkfilter(dta[["infl", "unemp"]])

我们在两端丢失了K个观测值。建议对季度数据使用K=12。

[13]:

fig = plt.figure(figsize=(12, 10))

ax = fig.add_subplot(111)

bk_cycles.plot(ax=ax, style=["r--", "b-"])

[13]:

<Axes: >

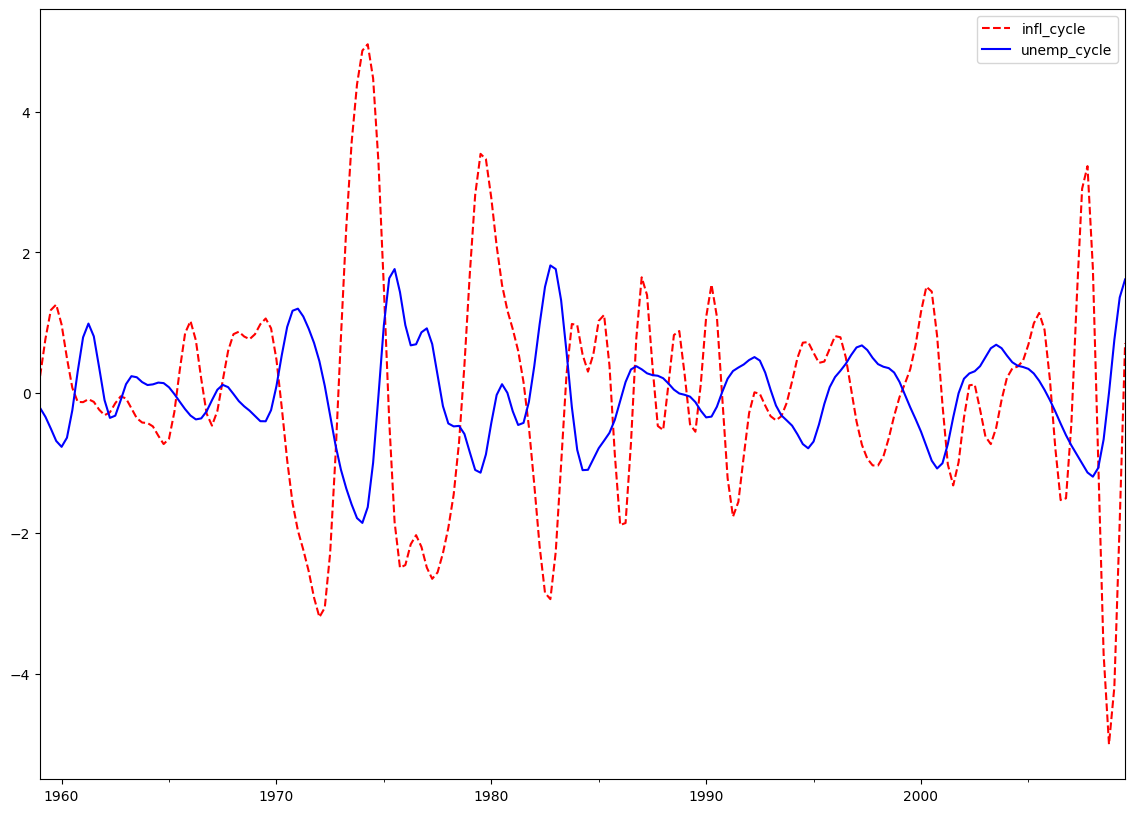

Christiano-Fitzgerald 近似带通滤波器: 通货膨胀和失业¶

Christiano-Fitzgerald 滤波器是 BK 的泛化,因此也可以被视为加权移动平均。然而,CF 滤波器在 \(t\) 处是不对称的,并且使用了整个序列。他们的滤波器的实现涉及在

对于 \(t=3,4,...,T-2\),其中

\(\tilde B_{T-t}\) 和 \(\tilde B_{t-1}\) 是 \(B_{j}\) 的线性函数,并且 \(t=1,2,T-1,\) 和 \(T\) 的值也是以类似的方式计算的。\(P_{U}\) 和 \(P_{L}\) 如上所述,具有相同的解释。

CF 滤波器适用于可能遵循随机游走的序列。

[14]:

print(sm.tsa.stattools.adfuller(dta["unemp"])[:3])

(np.float64(-2.5364584673346355), np.float64(0.10685366457233497), 9)

[15]:

print(sm.tsa.stattools.adfuller(dta["infl"])[:3])

(np.float64(-3.054514496257235), np.float64(0.030107620863486003), 2)

[16]:

cf_cycles, cf_trend = sm.tsa.filters.cffilter(dta[["infl", "unemp"]])

print(cf_cycles.head(10))

infl_cycle unemp_cycle

1959-03-31 0.237927 -0.216867

1959-06-30 0.770007 -0.343779

1959-09-30 1.177736 -0.511024

1959-12-31 1.256754 -0.686967

1960-03-31 0.972128 -0.770793

1960-06-30 0.491889 -0.640601

1960-09-30 0.070189 -0.249741

1960-12-31 -0.130432 0.301545

1961-03-31 -0.134155 0.788992

1961-06-30 -0.092073 0.985356

[17]:

fig = plt.figure(figsize=(14, 10))

ax = fig.add_subplot(111)

cf_cycles.plot(ax=ax, style=["r--", "b-"])

[17]:

<Axes: >

过滤假设先验存在商业周期。由于这一假设,许多宏观经济模型试图创建与脉冲响应函数形状相匹配的模型,而不是复制过滤序列的属性。请参阅VAR笔记本。