滚动回归#

配对交易是一种在算法交易中著名的技术,它将两只股票相互对冲。

为了实现这一点,股票必须具有相关性(协整)。

一个常见的例子是黄金(GLD)的价格和黄金开采业务(GFI)的价格。

import os

import warnings

import arviz as az

import matplotlib.pyplot as plt

import matplotlib.ticker as mticker

import numpy as np

import pandas as pd

import pymc as pm

import xarray as xr

from matplotlib import MatplotlibDeprecationWarning

warnings.filterwarnings(action="ignore", category=MatplotlibDeprecationWarning)

RANDOM_SEED = 8927

rng = np.random.default_rng(RANDOM_SEED)

%config InlineBackend.figure_format = 'retina'

az.style.use("arviz-darkgrid")

让我们加载GFI和GLD的价格。

# from pandas_datareader import data

# prices = data.GoogleDailyReader(symbols=['GLD', 'GFI'], end='2014-8-1').read().loc['Open', :, :]

try:

prices = pd.read_csv(os.path.join("..", "data", "stock_prices.csv")).dropna()

except FileNotFoundError:

prices = pd.read_csv(pm.get_data("stock_prices.csv")).dropna()

prices["Date"] = pd.DatetimeIndex(prices["Date"])

prices = prices.set_index("Date")

prices_zscored = (prices - prices.mean()) / prices.std()

prices.head()

| GFI | GLD | |

|---|---|---|

| Date | ||

| 2010-01-04 | 13.55 | 109.82 |

| 2010-01-05 | 13.51 | 109.88 |

| 2010-01-06 | 13.70 | 110.71 |

| 2010-01-07 | 13.63 | 111.07 |

| 2010-01-08 | 13.72 | 111.52 |

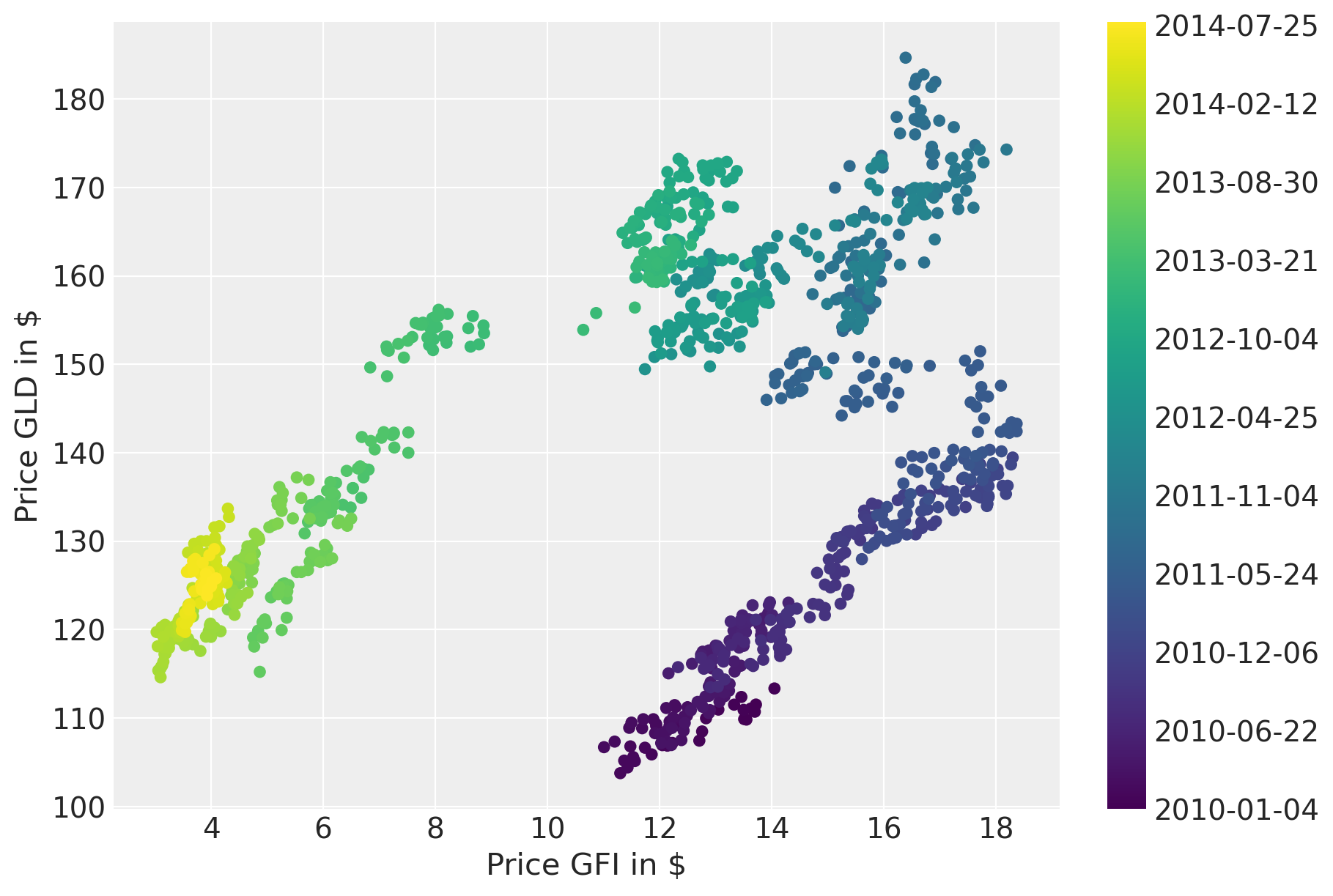

绘制价格随时间变化的趋势表明存在很强的相关性。然而,这种相关性似乎会随时间变化。

fig = plt.figure(figsize=(9, 6))

ax = fig.add_subplot(111, xlabel=r"Price GFI in \$", ylabel=r"Price GLD in \$")

colors = np.linspace(0, 1, len(prices))

mymap = plt.get_cmap("viridis")

sc = ax.scatter(prices.GFI, prices.GLD, c=colors, cmap=mymap, lw=0)

ticks = colors[:: len(prices) // 10]

ticklabels = [str(p.date()) for p in prices[:: len(prices) // 10].index]

cb = plt.colorbar(sc, ticks=ticks)

cb.ax.set_yticklabels(ticklabels);

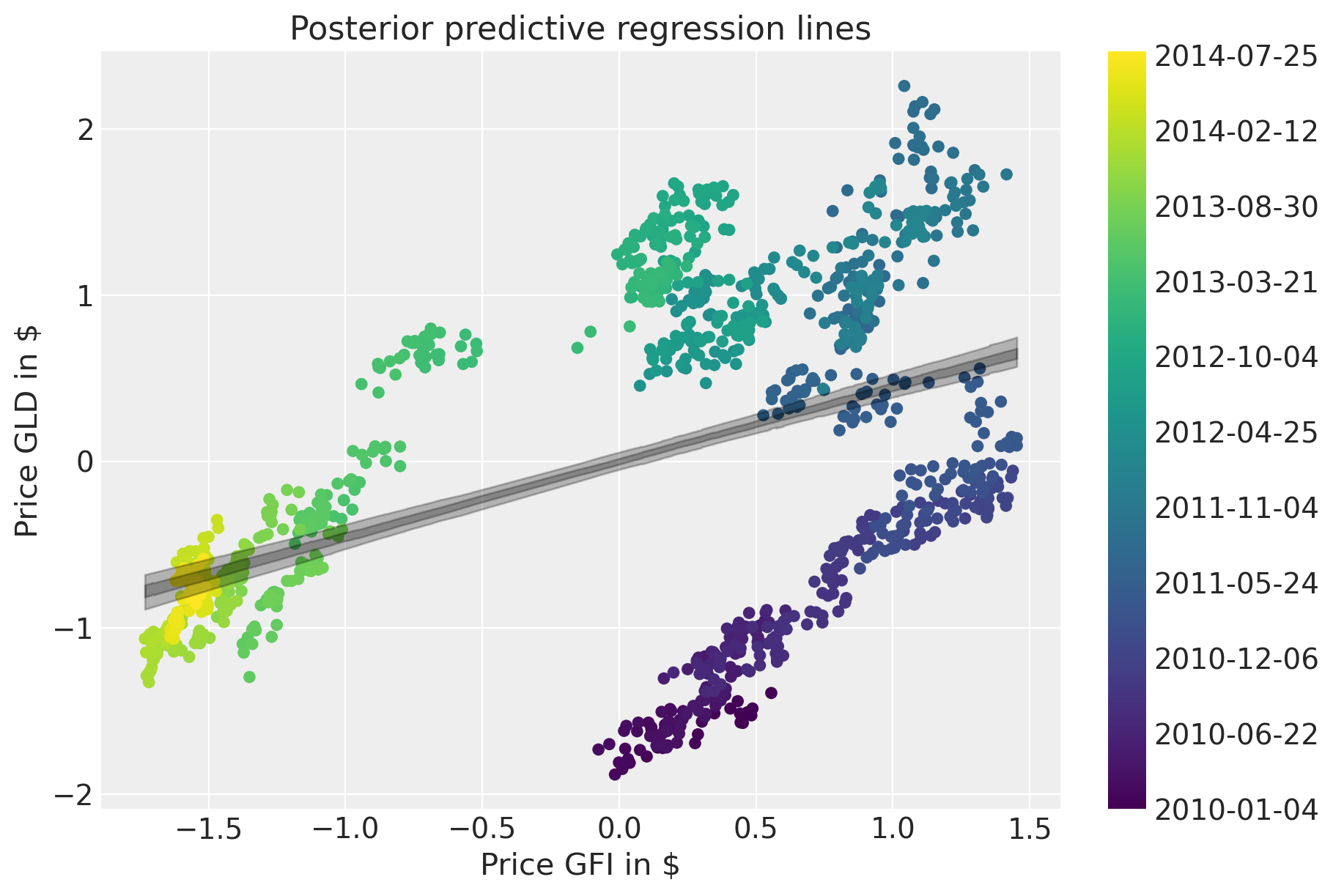

一个简单的方法是估计一个线性模型并忽略时间域。

with pm.Model() as model: # model specifications in PyMC are wrapped in a with-statement

# Define priors

sigma = pm.HalfCauchy("sigma", beta=10)

alpha = pm.Normal("alpha", mu=0, sigma=20)

beta = pm.Normal("beta", mu=0, sigma=20)

mu = pm.Deterministic("mu", alpha + beta * prices_zscored.GFI.to_numpy())

# Define likelihood

likelihood = pm.Normal("y", mu=mu, sigma=sigma, observed=prices_zscored.GLD.to_numpy())

# Inference

trace_reg = pm.sample(tune=2000)

100.00% [12000/12000 00:00<00:00 Sampling 4 chains, 0 divergences]

Sampling 4 chains for 2_000 tune and 1_000 draw iterations (8_000 + 4_000 draws total) took 1 seconds.

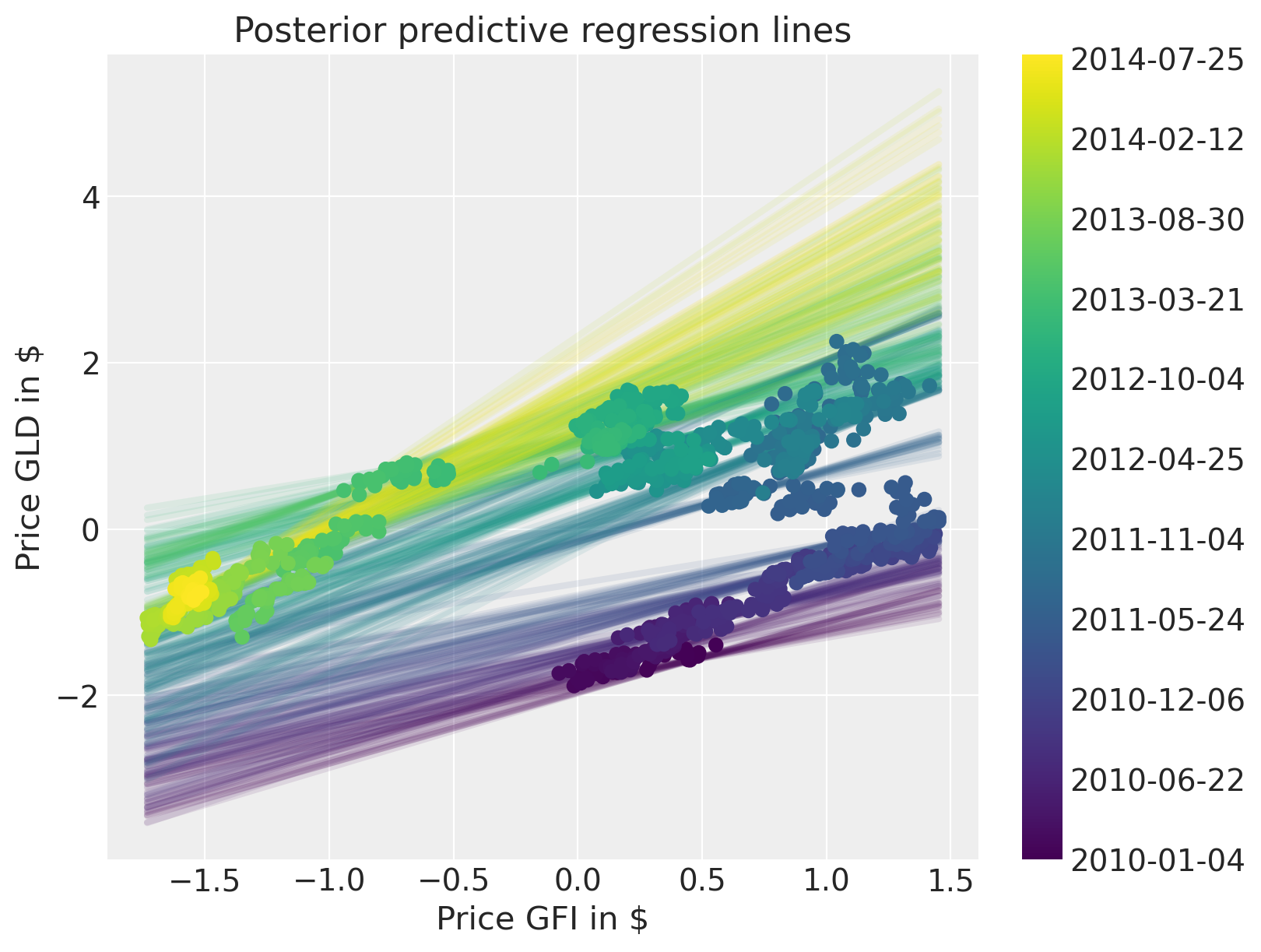

后验预测图显示了拟合的糟糕程度。

fig = plt.figure(figsize=(9, 6))

ax = fig.add_subplot(

111,

xlabel=r"Price GFI in \$",

ylabel=r"Price GLD in \$",

title="Posterior predictive regression lines",

)

sc = ax.scatter(prices_zscored.GFI, prices_zscored.GLD, c=colors, cmap=mymap, lw=0)

xi = xr.DataArray(prices_zscored.GFI.values)

az.plot_hdi(

xi,

trace_reg.posterior.mu,

color="k",

hdi_prob=0.95,

ax=ax,

fill_kwargs={"alpha": 0.25},

smooth=False,

)

az.plot_hdi(

xi,

trace_reg.posterior.mu,

color="k",

hdi_prob=0.5,

ax=ax,

fill_kwargs={"alpha": 0.25},

smooth=False,

)

cb = plt.colorbar(sc, ticks=ticks)

cb.ax.set_yticklabels(ticklabels);

滚动回归#

接下来,我们将构建一个改进的模型,该模型将允许回归系数随时间变化。具体来说,我们将假设截距和斜率随时间进行随机游走。这一想法类似于case_studies/stochastic_volatility。

\[ \alpha_t \sim \mathcal{N}(\alpha_{t-1}, \sigma_\alpha^2) \]

\[ \beta_t \sim \mathcal{N}(\beta_{t-1}, \sigma_\beta^2) \]

首先,让我们为\(\sigma_\alpha^2\)和\(\sigma_\beta^2\)定义超先验。这个参数可以解释为回归系数中的波动性。

with pm.Model(coords={"time": prices.index.values}) as model_randomwalk:

# std of random walk

sigma_alpha = pm.Exponential("sigma_alpha", 50.0)

sigma_beta = pm.Exponential("sigma_beta", 50.0)

alpha = pm.GaussianRandomWalk(

"alpha", sigma=sigma_alpha, init_dist=pm.Normal.dist(0, 10), dims="time"

)

beta = pm.GaussianRandomWalk(

"beta", sigma=sigma_beta, init_dist=pm.Normal.dist(0, 10), dims="time"

)

执行给定系数和数据的回归,并通过似然法与数据建立链接。

with model_randomwalk:

# Define regression

regression = alpha + beta * prices_zscored.GFI.values

# Assume prices are Normally distributed, the mean comes from the regression.

sd = pm.HalfNormal("sd", sigma=0.1)

likelihood = pm.Normal("y", mu=regression, sigma=sd, observed=prices_zscored.GLD.to_numpy())

推理。尽管这是一个相当复杂的模型,NUTS 处理得很好。

with model_randomwalk:

trace_rw = pm.sample(tune=2000, target_accept=0.9)

100.00% [12000/12000 06:22<00:00 Sampling 4 chains, 0 divergences]

Sampling 4 chains for 2_000 tune and 1_000 draw iterations (8_000 + 4_000 draws total) took 383 seconds.

增加树的深度确实有帮助,但这会使采样变得非常慢。不过,这次运行的结果看起来是相同的。

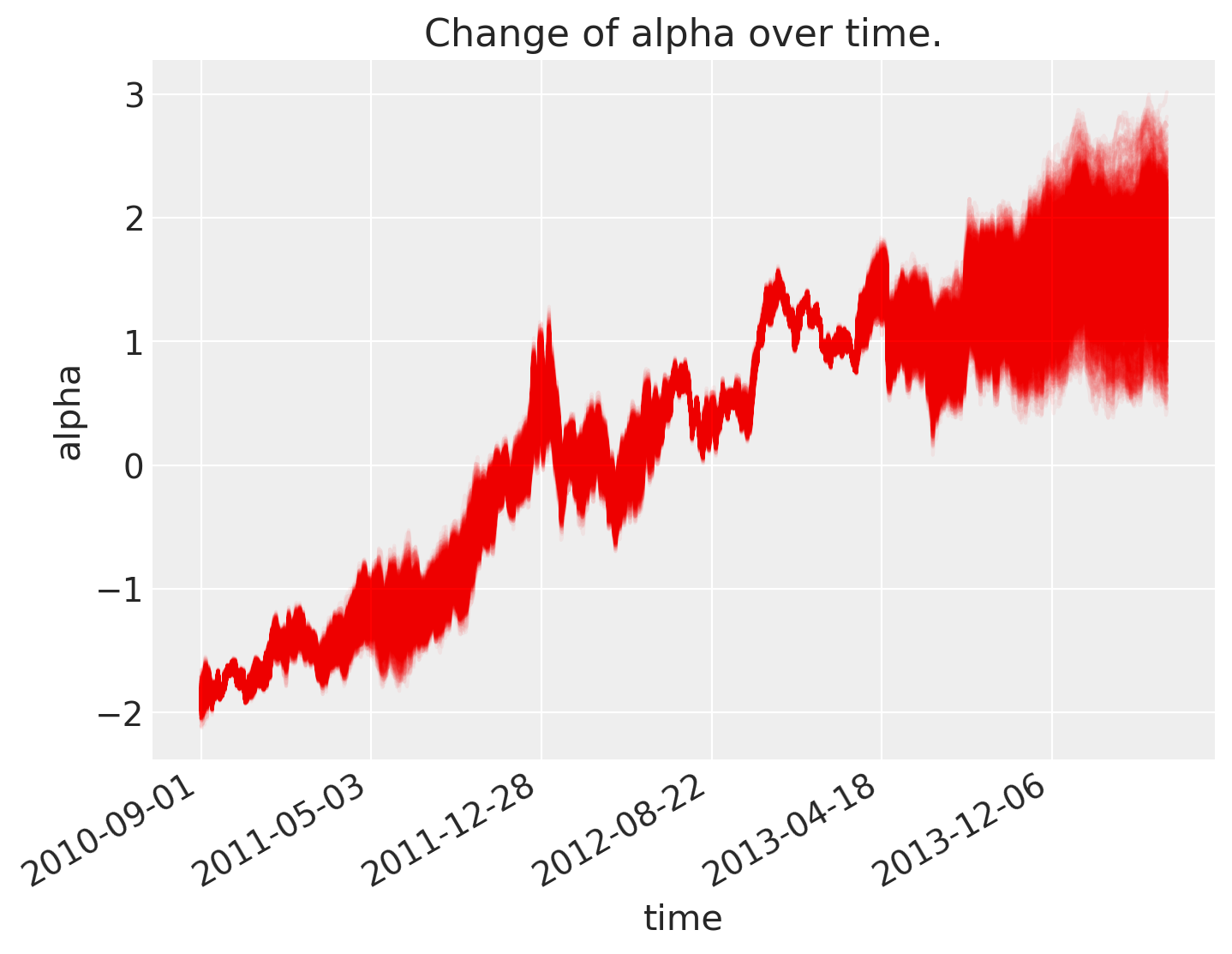

结果分析#

如下所示,\(\alpha\),即截距,随时间变化。

fig = plt.figure(figsize=(8, 6), constrained_layout=False)

ax = plt.subplot(111, xlabel="time", ylabel="alpha", title="Change of alpha over time.")

ax.plot(az.extract(trace_rw, var_names="alpha"), "r", alpha=0.05)

ticks_changes = mticker.FixedLocator(ax.get_xticks().tolist())

ticklabels_changes = [str(p.date()) for p in prices[:: len(prices) // 7].index]

ax.xaxis.set_major_locator(ticks_changes)

ax.set_xticklabels(ticklabels_changes)

fig.autofmt_xdate()

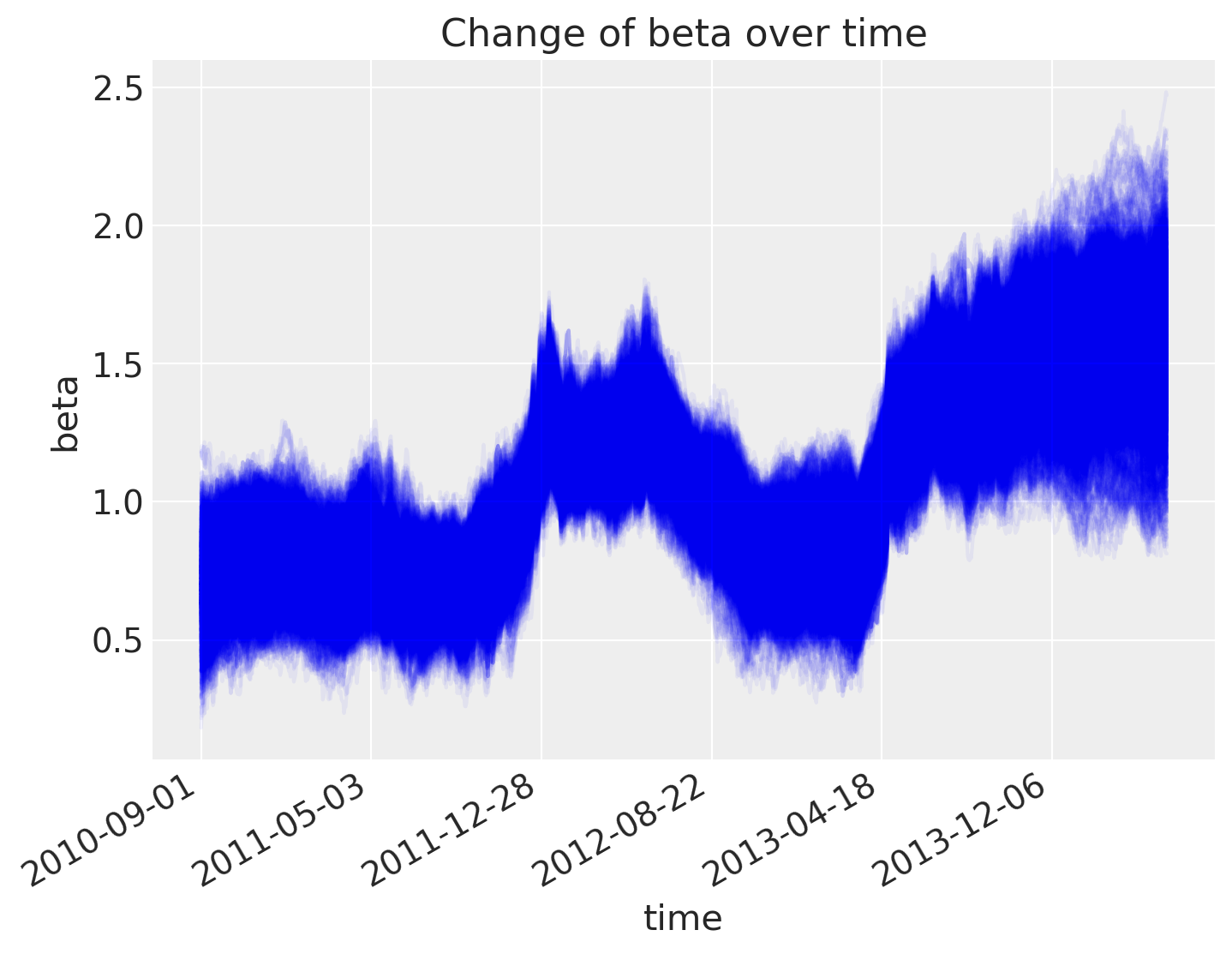

斜率也是如此。

fig = plt.figure(figsize=(8, 6), constrained_layout=False)

ax = fig.add_subplot(111, xlabel="time", ylabel="beta", title="Change of beta over time")

ax.plot(az.extract(trace_rw, var_names="beta"), "b", alpha=0.05)

ax.xaxis.set_major_locator(ticks_changes)

ax.set_xticklabels(ticklabels_changes)

fig.autofmt_xdate()

后验预测图显示,我们更好地捕捉了回归随时间的变化。请注意,我们应该使用收益率而不是价格。模型的工作原理仍然相同,但可视化效果不会那么清晰。

fig = plt.figure(figsize=(8, 6))

ax = fig.add_subplot(

111,

xlabel=r"Price GFI in \$",

ylabel=r"Price GLD in \$",

title="Posterior predictive regression lines",

)

colors = np.linspace(0, 1, len(prices))

colors_sc = np.linspace(0, 1, len(prices.index.values[::50]))

xi = xr.DataArray(np.linspace(prices_zscored.GFI.min(), prices_zscored.GFI.max(), 50))

for i, time in enumerate(prices.index.values[::50]):

sel_trace = az.extract(trace_rw).sel(time=time)

regression_line = sel_trace["alpha"] + sel_trace["beta"] * xi

ax.plot(

xi,

regression_line.T[:, 0::200],

color=mymap(colors_sc[i]),

alpha=0.1,

zorder=10,

linewidth=3,

)

sc = ax.scatter(

prices_zscored.GFI, prices_zscored.GLD, label="data", cmap=mymap, c=colors, zorder=11

)

cb = plt.colorbar(sc, ticks=ticks)

cb.ax.set_yticklabels(ticklabels);

水印#

%load_ext watermark

%watermark -n -u -v -iv -w -p pytensor,aeppl,xarray

Last updated: Sun Feb 05 2023

Python implementation: CPython

Python version : 3.10.9

IPython version : 8.9.0

pytensor: 2.8.11

aeppl : not installed

xarray : 2023.1.0

arviz : 0.14.0

xarray : 2023.1.0

numpy : 1.24.1

matplotlib: 3.6.3

pymc : 5.0.1

pandas : 1.5.3

Watermark: 2.3.1

许可证声明#

本示例库中的所有笔记本均在MIT许可证下提供,该许可证允许修改和重新分发,前提是保留版权和许可证声明。

引用 PyMC 示例#

要引用此笔记本,请使用Zenodo为pymc-examples仓库提供的DOI。

重要

许多笔记本是从其他来源改编的:博客、书籍……在这种情况下,您应该引用原始来源。

同时记得引用代码中使用的相关库。

这是一个BibTeX的引用模板:

@incollection{citekey,

author = "<notebook authors, see above>",

title = "<notebook title>",

editor = "PyMC Team",

booktitle = "PyMC examples",

doi = "10.5281/zenodo.5654871"

}

渲染后可能看起来像: